Data sources and compilation methods

Introduction

4.1 In Australia, data from the Department of Home Affairs (and its predecessors) has been the primary source of international merchandise trade statistics for over 100 years. The ABS uses information from the Department of Home Affairs which has been provided to them by importers, exporters, shipping companies, airlines, freight forwarders, or agents on behalf of these businesses, so that the goods can be cleared for entry to, or export from, Australia.

4.2 This chapter describes the exports and imports information which is collected by the Department of Home Affairs and transferred to the ABS. The way the ABS receives, transforms, quality assures and aggregates data for dissemination is explained. The small number of non-Department of Home Affairs data sources are also described.

Department of Home Affairs data

4.3 The Department of Home Affairs is the federal authority responsible for the collection and management of export and import documentation. The documentation is used by the Department of Home Affairs to assess and collect duty and other revenue payable on imported goods, and to monitor and control the physical movement of goods into and out of Australia.

4.4 For exports, declaration information must be lodged by exporters (or their agents) with the Department of Home Affairs prior to, and up to six months before, the departure of the goods. In mid-2013, 99.7% of all export declarations were submitted electronically. Electronic cargo manifests are mandatory for each international voyage and flight.

4.5 For imports, a declaration must be lodged with, and cleared by the Department of Home Affairs before access to the goods can be obtained. Import declarations may be lodged well in advance of the expected arrival of the goods. Over 99.5% of import declarations are reported electronically to the Department of Home Affairs.

4.6 The system used by the Department of Home Affairs to collect and process export and import information is known as the Integrated Cargo System (ICS). When a declaration is entered into the ICS a range of checks are applied to ensure that only valid codes for the commodity, country, port etc are used and that all mandatory information has been entered. Warning messages are sent to alert importers and exporters of possible errors. The Department of Home Affairs checks are aimed at ensuring compliance with customs laws in an environment of self-regulation and risk assessment. In practice, this means that while most declarations are processed without intervention, compliance is assured through the Department of Home Affairs legislative power to monitor and intercept cargo and to audit company records and practices. Where evidence of non-compliance with customs legislation is identified, compliance can be enforced by imposing sanctions or fines or by prosecution.

Exports information

4.7 Every day (including weekends and public holidays) the ICS produces a file that includes export declarations and manifests processed on the previous day and transmits the file to the ABS overnight. Table 4.1 lists the export data items received from the Department of Home Affairs in the daily files. While some data items have been grouped in the table below, for example, quantity has been grouped with the unit of quantity, each item included in the grouping is listed in the description. In addition to the data listed below, the ABS also receives management information, to verify the full receipt of Department of Home Affairs data files. Appendix 5 lists these data items and explains whether they are available in ABS aggregate output.

| Department of Home Affairs exports data (a) | Description |

|---|---|

| Header - this information applied to all lines on an export consignment | |

| Export Declaration Number (EDN) (b) | A unique identifier assigned by the Department of Home Affairs to identify an export declaration for each individual consignment of goods intended for export. |

| Status, version number and lodgement date (b) | Information to indicate the status and version of the EDN (used by ABS and the Department of Home Affairs to identify and process new, withdrawn or updated/changed export records). The lodgement date is the date the declaration is received by the Department of Home Affairs. |

| Sender reference | A unique business-level reference number assigned by the organisation who lodged the EDN. Used by the ABS when querying the information reported to the Department of Home Affairs.. |

| Exporter and agent identification | Information about the organisations that own and/or lodged the EDN (Australian Business Number (ABN) or Customs Client Identifier (CCID)). |

| Confirming export type | Indicates if the EDN is subject to confirming export arrangements, see Glossary. |

| Port of loading | The United Nations Location Code (UN/Locode) of the Australian port where the goods will be loaded onto a vessel or aircraft for export. |

| Country of final destination | The 2-character country code for the country of final destination. |

| Intended date of export | The date the goods are intended to be exported. |

| Port of discharge | UN/Locode of the foreign port where the goods will be discharged from the vessel or aircraft. This is the first port or airport of discharge, |

| Mode of transport | A code to indicate the method of transport i.e. sea or air. |

| Export goods type | A code to indicate the type of goods being exported i.e. stores, spares, postal goods, accompanied baggage, goods exported under their own power, other goods (any goods not included in previous categories). |

| Vessel or flight information | Information to identify the vessel or aircraft (if applicable) transporting the goods. |

| Invoice currency code | A code to indicate the currency of the invoice, see paragraph 3.23. |

| FOB currency code | A code to indicate the currency of the FOB value, see paragraph 3.23 and Appendix 4. |

| Total FOB value | The total value of the goods in the consignment, including freight costs and other charges, at the point when the goods are loaded onto the vessel or aircraft for export. |

| EDN lines - information about the goods exported (consignment line information) | |

| Line number (b) | A unique number assigned by the Department of Home Affairs to each line of cargo. This field together with the EDN identifies a single export transaction. |

| AHECC code | The AHECC which applies to the goods being exported. |

| Goods origin code | The code used to identify the Australian (or foreign) state of origin of goods. |

| Goods description | A free text field which describes in plain English the goods for export. |

| Quantity and the unit of quantity | The net quantity of the goods (excludes packaging) and the unit of quantity which applies to the AHECC. |

| Gross weight and the unit of gross weight | The gross weight (includes packaging but excludes the carrier's container etc) of the goods and the unit of quantity used to measure the gross weight (grams, kilograms or tonnes). |

| FOB value | The value of the goods including freight costs and other charges, at the point when the goods are loaded onto the vessel or aircraft for export. |

| Temporary import number | An identifier provided by the ICS when the same goods were imported on a temporary basis. |

| Assay information | For exports of some metalliferous ores, the element code, as in the Periodic Table e.g. AU for Gold, its concentration in the ore and its unit of concentration. |

| Vessel or aircraft manifest header - this information is the same for all lines on the manifest | |

| Manifest number | A unique number which identifies the manifest. |

| Port of departure | The UN/Locode of the port from which the goods left Australia. |

| Date of departure | The date the vessel or aircraft left Australia. |

| Airline code/Vessel id | Code to indicate the airline or vessel used to transport the goods overseas. |

| Manifest lines | |

| EDNs | A list of EDNs included on the manifest. |

a. More information regarding this data is available in the Department of Home Affairs Export Control Manual - Vol 12 which can be accessed from the Export Declaration Documents page of the Department of Home Affairs website.

b. Where amendments or changes to earlier declarations are received these are identified using the combination of EDN and Line number and status fields.

Imports and clearances information

4.8 After midnight each day the ICS produces a file of import and clearance records which were finalised by the Department of Home Affairs in the previous 24 hours. The file is transmitted to the ABS overnight. Table 4.2 below lists the import data received daily from the Department of Home Affairs. While some data items have been grouped in the table, for example, duty calculation fields, each item included in the grouping is listed in the description. Appendix 5 (in the Data downloads section) lists these data items and explains whether they are available in ABS aggregate output.

| Department of Home Affairs import data items (a) | Description |

|---|---|

| Header - this information applies to all lines on an import consignment | |

| Import Declaration Number (IDN) (b) | A unique identifier assigned by the Department of Home Affairs and used to identify an import declaration for each individual consignment of goods intended for import. |

| Broker/agent details | Information about the business lodging the declaration with the Department of Home Affairs. The fields include a branch identifier for multi-State brokers, ABN or CCID and document owner type (importer or customs broker). |

| Broker/agent reference | A unique business-level reference number assigned by the organisation that lodged the IDN. Used by the ABS when querying the information reported to the Department of Home Affairs. |

| Importer and reference details | Information about the importer (ABN or CCID) and their internal reference number so that they can identify the goods if queried by the Department of Home Affairs or the ABS. |

| Vessel or flight information | Information to identify the vessel or aircraft transporting the goods. |

| Mode of transport | A code to indicate the method of transport, i.e. air, sea, post, other (e.g. hand carried by a passenger). |

| Custom document version number | A derived number to indicate the version number of the IDN. |

| Lodgement date | The date of lodgement of the IDN (not the date of any amendments to the IDN). |

| Port of loading | The UN/Locode for the place where the goods were loaded onto the aircraft or ship for transportation to Australia. |

| Date of arrival | The date of arrival at the first Australian port, of the carrier where any goods were, or will be, discharged. |

| Port of discharge | The UN/Locode for the first Australian port where goods will be, or were, unloaded. |

| Destination port code | The UN/Locode of the place in Australia where the goods are released from the Department of Home Affairs control. This may or may not be the same as the port of discharge or the State of consumption. |

| Total customs value | The total customs value for the consignment to the point of containerisation overseas on the ship or aircraft. The value sent to the ABS is in Australian dollars. Where the value is reported to the Department of Home Affairs in a foreign currency it is converted to Australian dollars by the ICS using the exchange rate applicable on the date of export from the place of export, see paragraphs 3.16-3.18. |

| Total CIF value | The total invoice value for the consignment including the cost of overseas transport and insurance to the point of arrival in Australia. The value sent to the ABS is in Australian dollars. Where the value is reported to the Department of Home Affairs in a foreign currency it is converted to Australian dollars by the ICS using the exchange rate applicable on the date of export from the place of export. |

| Total FOB value | The total value for the consignment including all costs (e.g. inland transport and insurance) relating to the goods until they reach the overseas place of export. The value sent to the ABS is in Australian dollars. Where the value is reported to the Department of Home Affairs in a foreign currency it is converted to Australian dollars by the ICS using the exchange rate applicable on the date of export from the place of export. |

| Invoice currency code | A code to indicate the currency as shown on the invoice. |

| Gross weight | Total weight of goods in the consignment, including packaging. The gross weight unit is kilograms. |

| IDN lines - information about the goods imported (consignment line information) | |

| Line number (b) | A number for each import line in the import consignment. This field together with the IDN identifies a single import or clearance transaction. |

| Line action code (b) | An action indicator for inserted, deleted or withdrawn lines. |

| Commodity classification | Received as two fields from the Department of Home Affairs (8-digit tariff classification number and 2-digit statistical code). |

| Goods description | A free text field which describes the goods for import. |

| Country of origin | The 2-character code for the country in which the goods were made, produced, manufactured or otherwise originated. |

| Customs value | The customs value for the goods included in the consignment line. The value sent to the ABS is in Australian dollars. Where the value is reported to the Department of Home Affairs in a foreign currency it is converted to Australian dollars by the ICS using the exchange rate applicable on the date of export from the place of export, see paragraphs 3.16-3.18. |

| Line nature type (nature of entry) | Indicates if the declaration is: Nature 10 - goods imported directly into home consumption Nature 20 - goods imported into a Department of Home Affairs bonded warehouse Nature 30 - goods cleared from a Department of Home Affairs warehouse. |

| Quantity and unit of quantity | The net quantity of the goods (excluding packaging) and the unit of quantity which applies to the 10-digit tariff item. |

| Second quantity and unit of quantity | Where applicable this is the second net quantity of the goods (excluding packaging) and the second unit of quantity which applies to the 10 digit tariff item. |

| Duty calculation fields | The following fields are used in the calculation of duty: customs value; country of origin; tariff classification rate; duty calculation type; preference origin country code; preference scheme type; preference rule type; treatment code; instrument type; instrument number; quantity and second quantity. |

| Duty payment fields | These fields cover the value of duty paid. The fields received are: line customs value duty amount; line payable duty amount; line other duty factor duty amount; line quantity duty amount; line second quantity duty amount. The duty payment values are in Australian dollars. |

| Line duty deferred amount | The value of the duty deferred for later payment. The line duty deferred is in Australian dollars. |

| Dumping duty payment fields | The amounts of dumping duty paid (if applicable) in Australian dollars. Includes the line dumping duty amount and line countervailing duty amount. |

| GST fields | Includes a number of GST related fields: GST amendment amount; line payable GST amount; line deferred GST amount; line exempted GST amount; line exemption GST code; line standard GST amount. These amounts are in Australian dollars. |

- More information regarding these data items is available in the Department of Home Affairs Documentary Import Declaration Comprehensive Guide which can be accessed from the from Clearing goods through the border page of the Department of Home Affairs website.

- Where amendments or changes to earlier declarations are received these are identified using the combination of Line Action Code, IDN and Line number.

Customs procedures

4.9 The relationship between the ABS and the Department of Home Affairs is defined in a signed agreement between the two agencies. Meetings between the deputies of both agencies are held annually and regular discussions occur at the work level. Together these arrangements ensure that both agencies understand the requirements of the other agency and ensures that the relationship remains strong.

4.10 The ABS receives a range of information about the customs procedures applied to transactions. This includes the line nature type, treatment code, duty fields and GST fields. The information supplied by Department of Home Affairs can be used to ensure the correct treatment of transactions in ABS statistics.

ABS compilation methods

4.11 In 2001 when the concepts, sources and methods (CSM) for international merchandise trade statistics was first published, ABS statistics were processed on a mainframe computer. Between 2003 and 2006 the international merchandise trade system was re-designed, tested and transferred to a new platform. Over a similar period the Department of Home Affairs were re-engineering their systems for collecting exports and imports information. While these system changes were significant in terms of the way data are collected, delivered and processed there was only minimal impact on statistical output (see Appendix 2 in the Data downloads section). If users of the statistics are interested in the previous systems and methods they should read the 2001 version of the CSM.

4.12 The IMT system uses standard ABS statistical infrastructure and tools with adaptations to cover the type of data (export and import declarations, not survey questions and answers) and the volume of data received on a daily basis.

4.13 The IMT system has a separate test environment for testing changes or new functionality prior to implementation in the production environment. The test environment is also used as a training environment.

Start the processing month

4.14 The timing of the processing cycle differs between exports and imports due to exports being compiled on a departure date basis and additional time allowed for the finalisation of export manifests. Consequently, for exports the commencement of the new processing month normally occurs around the middle of the reference month. For imports the commencement of the new processing month happens earlier, generally on the sixth working day.

4.15 Threshold edit values are set to manage processing workloads. These are used to ensure that all records with values above the thresholds and records with fatal or warning error messages are checked by ABS editors.

4.16 Before processing commences it is necessary to ensure that metadata changes taking effect from the current reference month have been implemented correctly. For example, if a new 10 digit commodity code is active in the ICS from 1 January 2014 this new code must be loaded to the IDW metadata before processing of January 2014 data commences.

Input Data Warehouse (IDW)

4.17 The IDW is a key database in the processing of international merchandise trade data. It is the repository for all export/import data and metadata, including:

- all the source data (including all versions of each transaction) from the Department of Home Affairs

- all amendments

- information added by ABS editors about the amendments

- all the metadata used by the IMT system (e.g. commodity, country and port codes and descriptions) and some metadata which can be used to link international merchandise trade data to other ABS economic surveys e.g. ABN

- additional transactions which are added when customs data are not available, see the Other Data Sources section (paragraphs 4.55-4.56).

Exports and imports data load (to the IDW)

4.18 The data load processes initially re-format and map some customs data items to ABS data items. The most important re-mapping is for any fields which use the UN/Locode (i.e. the country, port and state fields). This is because when the Department of Home Affairs introduced the UN/Locode in their system (with the introduction of the ICS) the ABS decided to minimise changes to the IMT system and statistical output by continuing to use the previous country, port and State codes, (see Diagram 6.1 in the Country, Overseas Port, State and Australian Port chapter).

4.19 Processing stage codes are added to records in the data load to IDW. These codes are used throughout the IMT system to identify particular record types and their status at particular processing points.

Out of scope records

4.20 The load process identifies out of scope transactions which are not edited but are still loaded to the IDW for analytical purposes. The following record types are out of scope of international merchandise trade statistics.

- Consular records: These are transactions covering goods sent to Australian diplomats overseas (do not subtract from Australia's stock of material resources) or brought to Australia for foreign diplomats stationed here (do not add to Australia's stock of material resources). These transactions are internal flows and are out of scope for international merchandise trade statistics (see paragraph 2.47 in the Scope, Coverage and Treatments chapter).

- Customised software records: Some goods transactions are considered services. Where possible these are identified in the load e.g. computer software with a calculated unit value (reported customs value divided by reported quantity) greater than $10,000.00 is an indication that the software is customised and not an off the shelf product (see paragraph 2.49 in the Scope, Coverage and Treatments chapter).

- Value below the threshold: The customs thresholds which require the lodgement of a customs declaration are described in the Scope, Coverage and Treatments chapter (paragraph 2.8). Import consignment lines which are below the threshold ($1,000) are often received because they are part of a consignment of goods which includes lines above the threshold or because the goods for import are tobacco and alcohol which require a full declaration regardless of value. These low value lines are treated as out of scope. Export consignments with values below the consignment threshold ($2,000) are also received as an export permit may apply to the commodity. These are also treated as out of scope. This treatment ensures a consistent approach as the records identified as out of scope only represent a small proportion of the value and volume of goods below these thresholds. Value estimates for goods below the thresholds are included in Australia's balance of payments statistics.

- Outside the revision period: Amendments for records which are outside the ABS revision period (see paragraphs 10.15-10.16 in the Data Dissemination chapter).

- Bank notes in circulation: These are out of scope when they are valued at their face value and represent a financial transaction (see paragraph 2.46 in the Scope, Coverage and Treatments chapter). As these records are not easily identified in the load process it is more likely that they are changed to out of scope by an ABS editor.

4.21 Replacement or amendment records which alter an out of scope record to in-scope record are edited and included in international merchandise trade statistics.

Exports and imports edit

4.22 Once the export and import data are loaded to the IDW, all in-scope records are passed through their respective edit process (exports or imports edit). The edit process checks the details of each transaction against a set of edit conditions which are categorised as fatal, warning (notifiable) or informative. Transactions which fail fatal or warning edits then have messages sent to the edit/amendment system for investigation by an ABS editor. The investigation may require contact with the exporter, importer or agent to resolve. Informative edits usually indicate an automated system adjustment has been applied. Transactions which fail informative edits are not viewed by an ABS editor unless they also contain a fatal or warning edit.

4.23 The following list describes the most common edit checks applied to both export and import data:

- identification of all transactions with values equal to or above a large value threshold. These transactions are subject to detailed checks including confirmation with the exporter, importer or their agent if necessary

- internal consistency checks e.g. if the mode of transport is reported as sea, the Australian and overseas ports should not be airports

- unit value and for exports gross weight unit value edits are applied. These edits are generally informative and are only assigned to editors if they fail a warning or fatal edit

- automatic adjustment of certain import records, where the unit values fall well outside the expected range for the relevant HS classification. The quantity is assumed to be in error and is estimated

4.24 To ensure that ABS editors focus on the most significant transactions, and to minimise contact with exporters, significance editing is used in conjunction with many of these edit checks. Significance editing gives a score to all transactions to indicate how the reported value (exports FOB value, imports customs value) differs from a predicted value. The size of the score is an indication of the potential error. Transactions with scores beyond the significance score thresholds are flagged for review by an ABS editor. The score is allocated based on data calculated by the input editing benchmarks. The input editing benchmarks use the previous 12 months of data to determine if quantity or gross weight is the best predictor of value.

4.25 The re-edit process is essentially the same as the edit process but occurs following editor amendment whereas the edit process occurs when a new transaction (or revised version of a transaction) is received from the Department of Home Affairs.

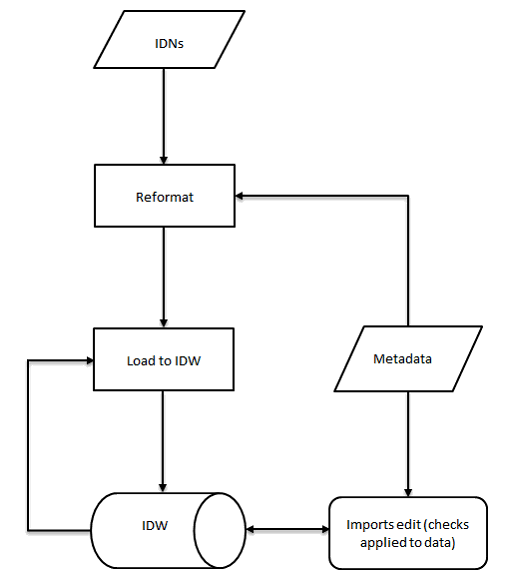

4.26 Chart 4.3 below shows the imports data load where the IDN information from the Department of Home Affairs is re-formatted and loaded to the IDW. Earlier versions of an IDN which are already on the IDW are identified (to ensure that the new version is not loaded as a new transaction) and up-dated in the Load to the IDW process. In Chart 4.3 below, this is shown as data moving from the IDW back to the 'Load to IDW' stage and then through to the IDW again. The metadata which is used in the Reformat and Imports edit processes includes the edit checks and country/port metadata. After the edit check a new version of the transaction with any relevant alerts is created in the IDW (shown as a two way arrow between the IDW and Imports edit).

Chart 4.3 Imports data load - process flowchart

4.27 There are many similarities in the exports and imports data load processes. However, they are separate processes involving different data items and metadata and there are some aspects which are unique to the exports load. The unique export processes are described in the following sections.

Exports matching process

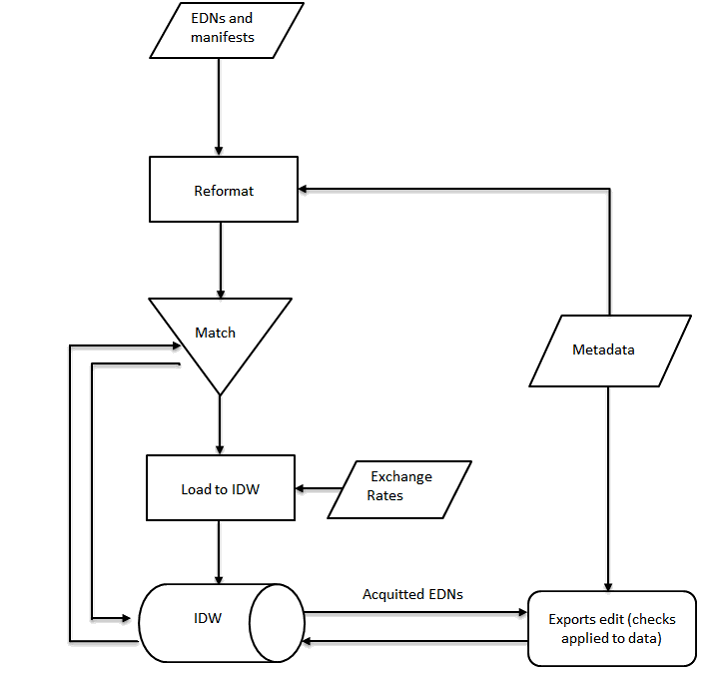

4.28 Exporters must complete an export declaration (EDN) with the Department of Home Affairs in advance of the goods arriving at the wharf for export. The EDN is an intention to export and includes preliminary information about when the goods will leave Australia and on what carrier the goods will be transported. The actual departure details are listed on the ship or aircraft manifest. When the ABS receives both the EDN and its manifest, the transaction is said to be acquitted 'matched' and the goods exported.

4.29 The exports matching process matches EDNs and manifests and adds the departure details from the manifest to the EDN information. In most cases the EDN is received by the ABS before the manifest. The EDN will be loaded to the IDW and identified as an EDN awaiting acquittal. Once the corresponding manifest is received the EDN is acquitted and, if the transaction has not been reported in Australian dollars, the Reserve Bank of Australia exchange rate for the day of departure will be used to convert values to Australian dollars. If the manifest is received first it is also loaded to the IDW but identified as a manifest record. When the EDN is received, the matching process retrieves the manifest from the IDW and the EDN is acquitted. This process of retrieving EDNs/manifests from the IDW and matching them with their corresponding manifests/EDNs is depicted with a two way arrow between the exports matching process and the IDW.

4.30 A small number of records are 'self acquitting'. This means the EDN is marked as acquitted (and therefore exported) without being shown on a manifest. Self acquitting EDNs are those export declarations which do not get recorded on a manifest. These are postal records, ships and aircraft exported under their own power, ship and aircraft stores and spares and unaccompanied baggage, identified by the relevant export goods type.

4.31 Because EDNs are lodged and passed to the ABS in advance of export, the exchange rate can be for a future date (and is therefore unknown). When these EDNs are loaded to the IDW the FOB value is estimated using the latest available exchange rate. To update these estimated records the load process checks for new exchange rates and retrieves the estimated records from the IDW. These records are passed through the load process again to update the information. In Chart 4.4 below, this is shown as data moving from the IDW back to the Match and 'Load to IDW' stages (with input of exchange rates) and then through to the IDW again.

Chart 4.4 Exports data load - process flowchart

Finalising monthly exports data

4.32 Towards the end of the processing month, a report is produced showing all unacquitted (no manifest received) large value EDNs with expected departure dates within the processing month. If the report shows an abnormally high value of unacquitted EDNs sometimes a decision to load more daily files to the IDW is made in the hope that manifests to acquit the EDNs are received. However, there comes a point where meeting the publication deadline means that no more data is loaded.

Edit/amendment system

4.33 The edit/amendment system is used to view and, if necessary, amend transactions that have been flagged by the edit process as requiring examination by an ABS editor. The system is also used to view and, if appropriate to do so, amend unusual transactions identified as requiring ABS editor attention (e.g. by output edit processes). Amendments are applied as a result of contact with the exporter or importer, identification of a repeated mis-reporting error or other information provided in the transaction or similar transactions. Any amendment of a transaction requires the ABS editor to include comments (which are appended to the transaction) to explain the change(s) made. All amended transactions go through the re-edit process to ensure data integrity and transactions failing re-edit checks are returned to the edit/amendment system for re-examination. The system also provides the means to view any transaction using its unique identifier. The system is also used by ABS editors and managers to monitor work flow e.g. the number of transactions awaiting editor attention (because they have failed fatal or warning edits).

Aggregate and output editing

4.34 Aggregate editing is an important component of statistical compilation and finalisation of output for release. Aggregate editing involves creating monthly totals by particular levels of commodity (HS 6-digit or SITC 2-digit), country, state, mode of transport and unit of quantity and comparing these to previously released aggregates. Significance scoring (scoring the current month aggregates against a benchmark derived from the previous 12 months of data) is used to highlight the most significant aggregate movements and to set workloads. Where necessary further follow-up with exporters and importers is undertaken and transactions amended. Records of any investigations and findings are kept and reviewed by more senior staff during the finalisation of output.

4.35 Output editing involves examining the data for particular commodities or 2-digit chapters of the HS. Examination of data at these levels may reveal a significant change. When this occurs the transactions contributing to the change are identified and scrutinised.

4.36 The trade query tool is an integral component of aggregate and output editing. The query tool allows staff to retrieve data from the IDW using a defined set of criteria. Simple reports can be produced, data aggregated and sorted to help ABS editors to understand movements or to resolve mis-reporting errors in the data. The trade query tool is also used in editing and verifying individual transactions. Where mis-reporting errors are found the relevant transactions are amended using the edit/amendment system.

4.37 International merchandise trade statistics are based on a large number of individual transactions and are released at a very detailed aggregated level e.g. 8-digit exports and 10-digit imports by Australian port, country and overseas port. As the ABS has limited resources available for ensuring the quality of international merchandise trade statistics, resources are focussed on the data required for macroeconomic statistics.

Output for Balance of Payments, National Accounts and Prices

4.38 Once editing is finalised and prior to the public release of international merchandise trade statistics, data are prepared for inclusion in the balance of payments.

4.39 The preparation of data for the balance of payments signals the first approval stage in the release of international merchandise trade statistics. The export and import data supplied for the balance of payments includes totals on a SITC and, for imports only, a BoPBEC basis, information about significant month to month movements and other information used to compile goods data on a balance of payments basis. More information regarding classifications such as SITC and BoPBEC and how data is prepared for the balance of payments is presented in the Classifications and Relationship with Other ABS Macroeconomic Statistics chapters respectively.

4.40 International merchandise exports statistics are first released on a balance of payments basis in International Trade in Goods (cat. no. 5368.0). Goods credits and debits on a balance of payments basis are closely related to international merchandise exports and imports but have been adjusted to take account of the principles of economic ownership and residence. More information can be found in the Relationship with Other ABS Macroeconomic Statistics chapter (paragraphs 12.4 to 12.7).

4.41 Australia's balance of payments is published quarterly in Balance of Payments and International Investment Position, Australia (cat. no. 5302.0). In this publication, the quarterly estimates of goods and services credits and debits are the sum of the months published in the corresponding release of International Trade in Goods (cat. no. 5368.0) without any changes. The quarterly exports and imports statistics which are included in the Expenditure on GDP estimates in the publication Australian National Accounts: National Income, Expenditure and Product (cat. no. 5206.0) are the same as those published in the quarterly balance of payments (so they include both goods and services and are on a balance of payments basis). Detailed exports and imports data on an international merchandise trade basis are supplied to the National Accounts Branch for use in compiling the annual supply-use tables, for input-output analysis and for other analytical purposes.

4.42 On a quarterly basis, data for the Prices Branch of the ABS are also prepared. The data include detailed Harmonized System commodity level data (8 digit export and 10 digit import) by country, value, quantity and gross weight. The data are used in the compilation of the International Trade Price Indexes, Australia (cat. no. 6457.0).

4.43 International merchandise trade data provided to the areas of the ABS which compile the balance of payments, national accounts and prices statistics include aggregates and some transactions level data so that the compilers of those statistics are able to fully understand and interpret the data for their

ABS Information Warehouse (ABSIW)

4.44 The ABS Information Warehouse (ABSIW) is the repository for data available for dissemination, including international merchandise trade statistics. Also stored on the ABSIW are all the metadata which make the statistics meaningful e.g. international merchandise trade commodity and country codes and descriptions and associated information. The ABSIW was created to enable all ABS data to be captured, defined and delivered in a consistent way.

4.45 At the end of the processing month after the data have been finalised and the output files created, international merchandise trade statistics are loaded to the ABSIW User database (an intermediate database where data are checked prior to release). The publication tables, time series spreadsheets and data cubes found on the ABS website are all extracted from the ABSIW User database. At 11.30am (Canberra time) on the day of release, the publication, all storage tables involving international merchandise trade data and metadata for the particular collection, time series spreadsheets and data cubes are copied from the ABSIW User database to the ABSIW Output database (output environment) and ABS Website.

4.46 Consultancy and subscription data are created from the ABSIW Output database from 11.30am on the day of release of the publication.

Other (non-Department of Home Affairs) data sources

4.47 There are only a small number of regular non-Department of Home Affairs data sources used in the compilation of international merchandise trade statistics. These data sources are:

- RBA exchange rates - these are used to convert exports FOB values to Australian dollars using the exchange rate applicable on the date of departure from Australia (or in some cases the expected date of export), see paragraph 4.34 in the ABS Compilation Methods section above

- public information - newspapers and websites are used to verify unusual transactions

- other ABS surveys or compilation areas - occasionally more up to date or additional information about goods being exported or imported might be provided by another ABS survey, for example, the quarterly Survey of New Capital Expenditure.

4.48 Export declarations are not required for fuel provided to foreign airlines and ships in Australia. The value of these transactions is estimated and included in Australia's merchandise export statistics using price and historical quantity data while alternative data sources are explored. In addition, because exports are recorded on a date of departure basis, occasionally research shows that a significant export has occurred for which no details have yet been received from the Department of Home Affairs. These transactions are added to the IDW towards the end of the processing month and processed in the same way as customs records i.e. once added the transaction(s) are passed through the edit process, subject to output editing and included in the final results.