- United Nations 2011, International Merchandise Trade Statistics: Concepts and Definitions 2010, Series M No. 52, New York, <http://unstats.un.org/unsd/trade/EG-IMTS/IMTS%202010%20(English).pdf> paragraph 6.4

- United Nations 2011, International Merchandise Trade Statistics: Concepts and Definitions 2010, Series M No. 52, New York, < http://unstats.un.org/unsd/trade/EG-IMTS/IMTS%202010%20(English).pdf> paragraph 6.13

- United Nations 2011, International Merchandise Trade Statistics: Concepts and Definitions 2010, Series M No. 52, New York, <http://unstats.un.org/unsd/trade/EG-IMTS/IMTS%202010%20(English).pdf> paragraph 6.11

Country, overseas port, state and Australian port

Introduction

6.1 International merchandise trade statistics by partner country are of significant analytical value. The statistics are used to calculate trade shares and analyse trade patterns and product markets. This information is used for business planning and for government trade policy and negotiations.

6.2 For attribution of partner country, the ABS classifies imports and import clearances according to the country of origin of goods and exports by country of final destination (this is the same concept as country of last known destination). Additionally for imports, the ABS receives port of loading and for exports overseas port of discharge from The Department of Home Affairs. In some cases, the country reported in these fields may be the country of consignment.

6.3 In compiling international merchandise trade statistics, Australia, like most other countries, uses customs records as the primary data source. Consequently the Department of Home Affairs' definition of Australia and foreign territories (a narrower definition than economic territory) is used. Australia's economic territory is defined in the Scope, Coverage and Treatment chapter (paragraph 2.5) and in the Glossary (see the Explanatory Notes tab). The definition of the economic territory of Australia's trading partners is defined by the Department of Foreign Affairs and Trade. In most cases these align with the trading partner's definition.

6.4 This chapter defines country of origin and country of final destination. It also explains the classifications used to collect, compile and disseminate country, state and port statistics.

Imports and import clearances

Country of origin

6.5 The country of origin of a good (for imports) is determined by Rules of Origin (ROO) established by each country. In Australia, the ROO are established in the Customs Tariff, Customs Tariff Act 1995, Customs Act 1901 and Customs (International Obligations) Regulation 2015. These rules, in addition to determining the country of origin of a good, also determine the base level of duty applicable on imported goods.

6.6 There are two common types of ROO depending upon application, the non-preferential and preferential ROO. Section 153Q of the Customs Act 1901 makes provision for non-preference ROO. For goods imported from a non-preference country, the country of origin is determined by whether the goods:

- are wholly manufactured in the country or

- if partly manufactured, the last process in the manufacture of the goods was performed in the country and the allowable factory cost (materials, labour and overheads) is not less than the specified percentage of their total cost. The specified percentage depends on whether the goods are of a kind commercially manufactured in Australia.

6.7 In relation to preferential ROO, Australia has entered into a number of Free Trade Agreements (FTAs) with other countries. These agreements provide preferential rates of duty (often free) for goods traded between these countries and Australia. When goods are imported, the importer or agent may be eligible to claim a preferential rate of duty under a particular trade or preference agreement. The importer is responsible for making the initial ROO self-assessment and the Department of Home Affairs will only review this application if specific intelligence indicates that the ROO has been applied incorrectly.

6.8 In Australia, rules of origin exist for all FTAs and preference schemes in order to distinguish eligible 'originating goods' of preference countries from the ineligible produce of that country and goods from other countries. Entitlement to preference is determined in accordance with Part VIII Division 1A - 1K of the Customs Act which provides the criteria for determining the origin of goods based on 'produce or manufacture of' a country. There are various rules of origin used in Australia's FTAs and preference schemes. The most common rules are:

- Wholly obtained - this is common to all agreements. If a product is a naturally occurring product of the country, or is made entirely in that country out of materials from that country, the good is considered to have originated in that country.

- Change in Tariff Classification - this refers to the Harmonized Commodity Description and Coding Classification System (HS) used in the Customs Tariff Act. The HS system categorises all goods and assigns them a code so that goods can be consistently identified internationally. This ROO requires that the HS classification of the final good imported from the preference country is different from the HS classification(s) of the materials imported into that country that were used to make the good. The ROO may require a small shift from a different Tariff Subheading or Heading, to a large shift from a different Tariff Chapter. If the necessary Change in Tariff Classification shift is met, then the goods meet the ROO.

- Regional Value Content (RVC) - this rule requires that a threshold amount of the final value of the good is attributable to production costs within the country. RVC rules can be calculated in various ways and these are specified in each agreement that uses them. RVC is a form of Value-Added rule and is sometimes known by that term.

- Process Rule - this requires the final good to have undertaken a particular manufacturing or processing operation in the preference country.

Other common rules which the Department of Home Affairs may apply include:

- Final process of manufacture - this rule requires goods to have undergone their final process of manufacture in the preference country prior to importation into Australia.

- Consignment - these provisions allow for the transport, and certain minimal procedures, of final goods through other countries on their way to Australia so that the final process of manufacture rule is not breached.

- De minimis - this rule allows for a specific amount of foreign/non-originating material. The amount is defined in the relevant legislative provisions for each FTA or preference scheme.

6.9 While the Department of Home Affairs' objective in applying different types of ROO is to limit preferential rates of duty to goods which meet their origin criteria, from a statistical perspective the rules ensure the country of origin is accurately recorded for goods subject to import duty.

6.10 The application of ROO may differ between countries as the concepts and definitions are generally not symmetrical. Where the rules are different it may lead to discrepancies in country attribution when imports recorded by one country are reconciled with the corresponding exports of a trading partner. For this reason, international guidelines on the criteria for establishing ROO are included in the Revised Kyoto Convention (RKC) which can be accessed from the UN Trade Statistics website.

6.11 The Department of Home Affairs has accepted and abides by the rules of the RKC but they have not adopted Annex K. This is because Annex K has a single set of rules governing the origin of goods while Australia's FTAs and preference schemes contain more specific rules. Nevertheless Australia's ROO follow the principles defined in the RKC. More detailed information is available in the Preferential Rules of Origin Publication and the official Free Trade Agreement documents, both available on the Department of Home Affairs website.

Overseas port of loading and country of consignment

6.12 Country of consignment is not part of the ABS merchandise trade dataset. However it is an important international partner country attribution, alongside country of origin, a concept worth understanding and how it relates to ABS port information. 'The country of consignment (in the case of imports) is the country from which goods were dispatched to the importing country, without any commercial transactions or other operations that change the legal status of the goods taking place in any intermediate country. If, before arriving in the importing country, goods enter one or more further countries and are subject to such transactions or operations, that last intermediate country where such transactions or operations took place should be taken as the country of consignment', see Footnote 1 (in the Footnotes section below).

6.13 In some cases, country of consignment may be the same as the country reported in the overseas port of loading field, which is the place where the goods are loaded onto an aircraft or ship for the purpose of being transported to Australia. Depending on the circumstances (the transportation details that are known by the importer and the accuracy of reporting), different information may be provided to the Department of Home Affairs. Three possibilities are described below. The overseas port of loading reported to the Department of Home Affairs is usually determined by the information contained in the bill of lading.

6.14 Goods wholly manufactured in China are exported to Australia. The goods are shipped direct from a Chinese port to an Australian port. In Australia's import statistics the country of origin should be recorded as China, the overseas port of loading should be a Chinese port and country of consignment (were it required by the Department of Home Affairs) should be China.

6.15 Goods wholly manufactured in China are exported to Australia but repackaged and consolidated in Singapore. In Australia's import statistics the country of origin should be recorded as China, the overseas port of loading should be Singapore and the country of consignment (were it required by the Department of Home Affairs) should be Singapore (as the repackaging and consolidation would be considered a commercial transaction that changes the legal status of the goods).

6.16 Goods wholly manufactured in China are exported to Australia but in Singapore the goods are unloaded and re-loaded onto a different carrier. In Australia's import statistics the country of origin should be recorded as China, the overseas port of loading should be Singapore (but could be reported on the import declaration as a Chinese port) and the country of consignment (were it required by the Department of Home Affairs) should be China (as the loading and re-loading of goods for export is not on its own a commercial transaction that changes the legal status of the goods).

Exports

Country of final destination

6.17 The ABS defines the country of final destination as 'the last country, as far as it is known at the time of exportation, to which goods are to be delivered. This is irrespective of where they have been initially dispatched to and whether or not, on their way to that last country, they are subject to any commercial transactions or other operations that change their legal status', see Footnote 2 (in the Footnotes section below).

Overseas port of discharge and country of consignment

6.18 Although country of consignment is not part of Australia's export statistics, it is an important international attribution. The country of consignment (in case of exports) 'is the country to which goods are dispatched by the exporting country, without - as far as it is known at the time of exportation - being subject to any commercial transactions or other operations that change the legal status of the goods taking place in any intermediate country', see Footnote 3 (in the Footnotes section below). Significant additional data reporting and data processing burden would be involved as countries often do not differentiate the country of final destination and the country of consignment.

6.19 In Australia, country of consignment in some cases may be the same as the country reported in the overseas port of discharge field, which is the place where goods are unloaded from an aircraft or ship after it leaves Australia. Depending on the circumstances (the transportation details that are known by the exporter and the accuracy of reporting), different information may be provided to the Department of Home Affairs. Three possibilities are described below.

6.20 Goods wholly manufactured in Australia are exported to China. The goods are shipped direct from an Australian port to a Chinese port. In Australia's export statistics, the country of final destination should be recorded as China, the overseas port of discharge should be China and the country of consignment (were it required by the Department of Home Affairs) should be China.

6.21 Goods wholly manufactured in Australia are exported to China but repackaged and consolidated in Singapore. In Australia's export statistics the country of final destination should be recorded as China, the overseas port of discharge should be Singapore and the country of consignment (were it required by the Department of Home Affairs) should be Singapore (as the repackaging and consolidation would be considered a commercial transaction that changes the legal status of the goods).

6.22 Goods wholly manufactured in Australia are exported to China but in Singapore the goods are unloaded and re-loaded onto a different carrier. In Australia's export statistics the country of final destination should be recorded as China, the overseas port of discharge should be Singapore (but could be reported on the export declaration as a Chinese port) and the country of consignment (were it required by the Department of Home Affairs) should be China (as the loading and re-loading of goods is not on its own a commercial transaction that changes the legal status of the goods).

Importance of country attribution

6.23 The recording of imports by country of origin shows the direct relationship between the producing country (the country in which the goods originate) and the importing country. This information is regarded as essential for matters of trade policy and negotiations, for administering import quotas or tariffs, and for related economic analysis.

6.24 There are, however, limitations to the use of data compiled on a country of origin basis. In principle, export and import statistics will only match between two countries when exports are shipped directly from the country of origin to the country of final destination. Discrepancies occur when third countries are involved, for example re-exports of merchandise traded through intermediate countries.

6.25 For example, goods produced in China, sold and shipped to Australia, are later resold and dispatched to New Zealand. China's statistics would most probably show these as exports to Australia, if at the time of export the goods are expected to remain in Australia. After a period of time has elapsed, Australia may then export the goods and record them as a direct transaction between Australia and New Zealand. New Zealand statistics would most likely not attribute the imports to Australia, but indicate that goods were imported from China (the country of origin). These trade movements complicate data comparability between partner countries.

6.26 Where countries also compile data by country of consignment this information can be used to explain differences in partner country statistics since it promotes the recording of the same transactions by importing and exporting countries. This offers the possibility of obtaining reasonably comparable statistics since goods recorded as imports by one country are to be recorded as exports by another.

Country trade balances

6.27 For the calculation of country trade balances, Australia's international merchandise trade statistics are classified by country of origin for imports and country of final destination for exports. Some country trade balances, consistent with the standard, are published in the Excel version of the country table i.e. Table 14 of International Trade in Goods (cat. no. 5368.0). The time series spreadsheets of Table 14 available on the ABS website do not include country trade balances but these can be easily calculated by subtracting Australia's imports from a country (Table 14b) from Australia's exports to that country (Table 14a).

6.28 Users should be aware that international merchandise trade statistics by country include the category 'Country not available for publication'. The category represents goods affected by confidentiality restrictions from September 2008 for imports, and from June 2013 for exports. More detail is contained in paragraph 9.24.

6.29 DFAT also publish a full range of country balances in its Composition of Trade, Australia publication. Interested users should refer to the DFAT website.

Country and overseas port classifications and processing

Location code and international merchandise trade codes

6.30 Three classifications are used in producing international merchandise trade statistics by country and overseas port. They are:

- UN location code at country and port level (used in export and import declarations reported to the Department of Home Affairs

- International merchandise trade country code (used in ABS publications and other outputs)

- International merchandise trade overseas port code (used in ABS publications and other outputs).

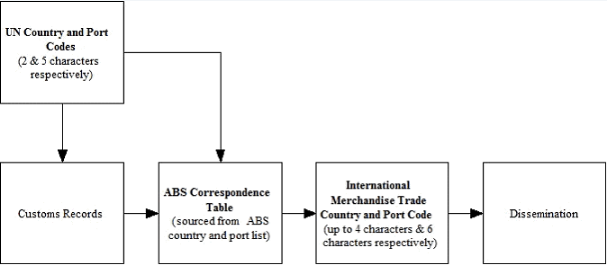

6.31 A correspondence table which links the input and output codes is used to allocate the UN location country and port codes supplied on customs records to the international merchandise trade country and overseas port codes. This process is shown in the Diagram 6.1 below.

Diagram 6.1 Process of converting UN country and port location codes to output codes

Image

Description

6.32 The United Nations Code for Trade and Transport Locations (commonly known as UN location code) is a list of countries and locations within countries developed and maintained by the United Nations Economic Commission for Europe (UNECE). As at June 2014, the UN location codes identify over 85,000 locations in 250 countries and installations in international waters. This classification is updated periodically to include new codes, amend existing codes and delete codes no longer required. A list of countries included in the UN location code is available in this link: UN Location code list by country. When goods for export or import are declared to the Department of Home Affairs the country of final destination/country of origin and overseas port are reported using a UN location code.

Country

6.33 The ABS maintains a table for the correspondence between the UN location country code and international merchandise trade country code where each two letter UN location country code is corresponded to an international merchandise trade country code of up to four letters (e.g. BR corresponds to 'BRAZ' with label 'BRAZIL'). In the ABS correspondence table, more than one UN location country code can be corresponded to a single international merchandise trade country code. Prior to the adoption of the UN location country code by the Department of Home Affairs in July 2003, the Department of Home Affairs and the ABS maintained a joint list of major country codes. A list of countries where the correspondence is not one UN location code to one ABS country is provided in Table 6.2 below.

| Country Name | UN location code | International merchandise trade country code | Areas included |

|---|---|---|---|

| Antarctica | AQ, HM | ANTC | Includes Heard Island and McDonald Islands |

| Finland | FI, AX | FINL | Includes Finland and Aland Islands |

| France | FR, MC, AD, YT | FRAN | Includes Monaco, Andorra and Mayotte |

| French Antilles | MF, GP, MQ, BL | FWIN | Includes St Martin (French part), Guadeloupe, Martinique and St Barthelemy |

| Israel | IL, PS | ISRA | Includes Occupied Palestinian Territory |

| Italy | IT, SM, VA | ITAL | Includes San Marino and the Vatican City State |

| Netherlands Antilles | AN, BQ, CW, SX, AW | ANTI | Includes Bonaire, St Eustatius and Saba, Curacao, St Martin (Dutch part) and Aruba |

| New Zealand | NZ, TK | NZ | Includes Tokelau |

| Norway | NO, SJ | NWAY | Includes Svalbard and Jan Mayen |

6.34 The ABS continues to maintain its own country and overseas port classifications:

- to facilitate analysis across time

- to minimise potential confidentialisation of data

- to avoid extensive changes to ABS processing systems and output formats.

6.35 The international merchandise trade country code is the output code used for the dissemination of international merchandise trade statistics by country. Changes to the international merchandise trade country codes are applied as soon as practicable after they have been:

- included in the UN location code classification

- recognised by DFAT

- implemented by the Department of Home Affairs in export and import documentation (e.g. included in Schedule 1, if relevant).

6.36 In some cases a new country is added to the UN location code classification but the country is not recognised by DFAT. In such instances, the new country code is corresponded to an existing international merchandise trade country code.

6.37 Appendix 7 (in the Data downloads section) provides the correspondence between UN location country codes and international merchandise trade statistics country codes. A list of countries used in the dissemination of international merchandise trade statistics is also provided in the pivot table in Appendix 8 (in the Data downloads section).

Re-imports

6.38 It is worth noting the concept of re-imports as it relates to country referring to goods originally exported, which are subsequently imported in either the same condition in which they were exported, or after undergoing repair or minor alteration which leaves them essentially unchanged. In Australia's international merchandise trade statistics, re-imports are published in a separate category in the country of origin classification. Re-imports are identified in ABS statistics as country of origin 'Australia'.

Overseas ports

6.39 The overseas port of loading (imports) and the overseas port of discharge (exports) are collectively referred to as overseas ports and are reported to the Department of Home Affairs using the 5 digit UN location port code. The ABS corresponds each five letter UN location port code to a six-digit international merchandise trade overseas port code (e.g. BRRIO, name of Rio de Janeiro corresponds to ABS overseas port code 076001 with label 'Rio de Janeiro'), see Diagram 6.1 above.

6.40 For international merchandise trade overseas port codes, some ports are not separately identified due to the low volume of trade that occurs in those ports. Where a port is not separately identified, it is included under 'Other and Unspecified ports' for the particular country e.g. FRAVN - Avignon is corresponded to 'Other and unspecified ports-France' with ABS overseas port code 250399. Where no ports are separately identified within a country the trade is included under 'All Ports' for the particular country e.g. AFJAA - Jalalabad is corresponded to 'All Ports-Afghanistan' with ABS overseas port code 004399.

6.41 International merchandise trade port codes are maintained using the UN location port code. In some cases more than one UN location port code can be corresponded to a single international merchandise trade port code. Tejgaon (BDTEJ), Dhaka (BDDAC) and Kamalapur/Dhaka (BDKAM) are corresponded to Dacca, Bangladesh with ABS overseas port code 050100.

6.42 The ABS undertakes ad hoc overseas port reviews to identify changes in trading patterns. Where the volume of trade for a port that is not separately identified has increased significantly it will become separately identified. Where there has been a significant decline in trade for a separately identified port it will cease to be separately identified and grouped with ‘Other and Unspecified ports’ for the country or 'Other and Unspecified ports' for the country may also close and 'all ports' for the country may be opened. Historical data outside the 6 month revision period is not amended to reflect these changes.

6.43 The overseas ports used in Australia's international merchandise trade statistics are included in the country and port pivot table in Appendix 8 (in the Data downloads section). Similar to International Merchandise Trade by country, the overseas port 'Confidential Overseas Port' represents for imports goods affected by confidentiality restrictions from September 2008. For exports the 'Confidential Overseas Port' also represents goods affected by confidentiality restrictions (see paragraph 6.28 in the Country Trade Balances section).

State

Imports

6.44 For imports the following are provided in respect of state:

- State of final destination is the Australian state in which the imported goods are released from customs control. It does not necessarily equate to the state in which goods were discharged or the state in which they were consumed. The state in which the goods were consumed would be more relevant for some economic analysis but this information is not available. The ABS derives the state of final destination from the customs field 'port of final destination' which is reported to the Department of Home Affairs using a UN location code. The port of final destination field is not used in any other way in ABS processing and is not available in output.

- State of discharge is the Australian State/Territory in which imported goods are unloaded from the international carrier. This state field is derived from the reported field Australian port of discharge. International merchandise trade statistics by state of discharge can only be obtained by aggregating data for all ports within a state.

6.45 Analysis of recorded merchandise imports for financial years 1996-97 to 2011-12 indicates that between 94% and 98% (on average 96%) of imports have identical state of discharge and state of final destination.

6.46 A list of state codes is included in Table 6.3 below.

6.47 Users should be aware that international merchandise trade statistics by state include the category 'State not available for publication'. For imports, the category represents goods affected by confidentiality restrictions from September 2008. More detail is contained in paragraph 9.24.

Exports

6.48 For exports the following are provided in respect of state:

- State of loading is the Australian state in which the goods are loaded onto an international carrier for export. This state field is derived from the reported Australian port of loading. International merchandise trade statistics by state of loading can only be obtained by aggregating data for all ports within a state.

- State of origin has a similar meaning to country of origin as it is the Australian state in which the whole of production occurs or the final stage of production or manufacture occurs. It does not necessarily equate to the state in which goods were loaded onto the international carrier. The state of origin of the good is specifically reported to the Department of Home Affairs with the code used for reporting spelt out in the explanatory notes of the ABS publication Australian Harmonized Export Commodity Classification (AHECC) - Electronic Publication (cat. no. 1233.0).

6.49 The state of loading and the state of origin may be different e.g. goods produced or manufactured in Tasmania may be loaded onto an international carrier for export in Victoria.

6.50 The concept of re-exports (i.e. goods originally imported which are exported in either the same condition in which they were imported, or after undergoing repair or minor alterations which leave them essentially unchanged) is important to note as it relates to state of origin. In Australia's merchandise trade statistics, re-exports are published as a separate category in the state of origin classification (see Table 6.3 below).

6.51 Users should be aware that international merchandise trade statistics by state include the category 'State not available for publication'. For exports, the category represents goods affected by confidentiality restrictions from June 2013. More detail is contained in paragraph 9.24.

| Code | Label | Description |

|---|---|---|

| 1 | NSW | New South Wales |

| 2 | VIC | Victoria |

| 3 | QLD | Queensland |

| 4 | SA | South Australia |

| 5 | WA | Western Australia |

| 6 | TAS | Tasmania |

| 7 | NT | Northern Territory |

| 8 | ACT | Australian Capital Territory |

| 9 | NSD | State not available for publication |

| 10 | REX | Re-exports (a) |

- The State 'Re-exports' does not apply to import statistics as it relates to state of origin. In Australia's international merchandise trade statistics, re-exports are published as a separate category in Table 15a of International Trade in Goods (cat. no. 5368.0). A Re-import is a country concept (not a state concept) so re-imports are included in Table 14 of International Trade in Goods (cat. no. 5368.0).

Australian ports

6.52 In Australia's international merchandise trade statistics Australian ports are derived from the UN location codes provided on the export and import declarations. The ABS corresponds each five letter UN location code to a three-digit international merchandise trade Australian port code (e.g. AUSYD corresponds to ABS Australian port code 101 with label 'Sydney'). The ABS Australian port code list includes combined offshore ports for Western Australia and the Northern Territory. These combined ports include a number of offshore facilities. For exports, the Australian port is the port of loading and for imports the Australian port is the port of discharge. The ABS maintains the international merchandise trade Australian port classification.

6.53 When changes to the international merchandise trade Australian port classification are necessary they will generally take effect from 1 July. Since July 2007, when changes are implemented to ABS port codes, statistics are recompiled for data within the revision period (see paragraphs 10.15 and 10.16 in the Data Dissemination chapter).

6.54 A list of port codes used in Australia's international merchandise trade statistics is included in the pivot table in Appendix 8 (in the Downloads tab). Similar to International Merchandise Trade by state, the Australian port 'Confidential Australian Ports' represents for imports goods affected by confidentiality restrictions from September 2008. For exports the 'Confidential Australian Ports' also represents goods affected by confidentiality restrictions (see paragraph 6.28 in the Country Trade Balances section).

Standard Australian Classification Of Countries (SACC)

6.55 The Standard Australian Classification of Countries (SACC) 2016 (cat. no. 1269.0), available on the ABS website, is the Australian statistical standard for social statistics classified by country. The SACC is a four-digit hierarchical classification, essentially based on the concept of geographic proximity. It groups neighbouring countries into progressively broader geographic areas on the basis of their similarity in terms of social, cultural, economic and political characteristics.

6.56 The SACC can be directly corresponded to the International Organization for Standardization country codes. The classification is intended for use whenever social, demographic and labour statistics are classified by country. The SACC, and UN location code have been broadly aligned at the most detailed level. The international merchandise trade country code classification aligns as far as practicable to the SACC. However, because international merchandise trade statistics are not fully aligned with the UN location code, consistent international merchandise trade statistics classified by the SACC list of countries cannot be easily produced.