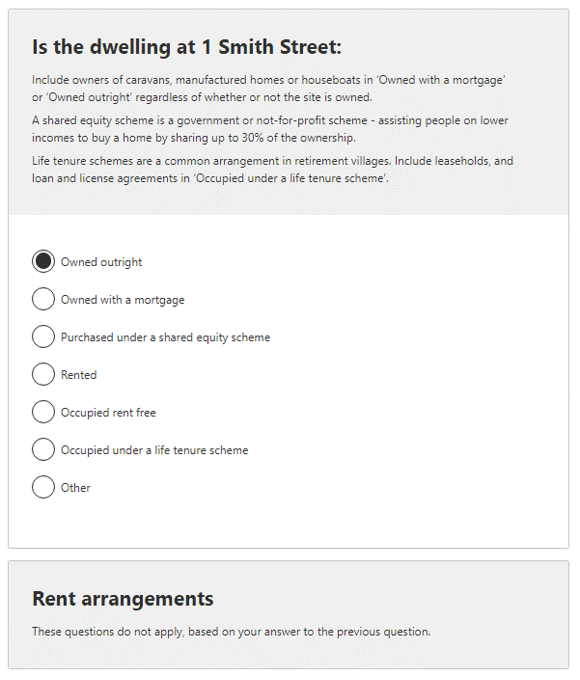

Image

Description

Example

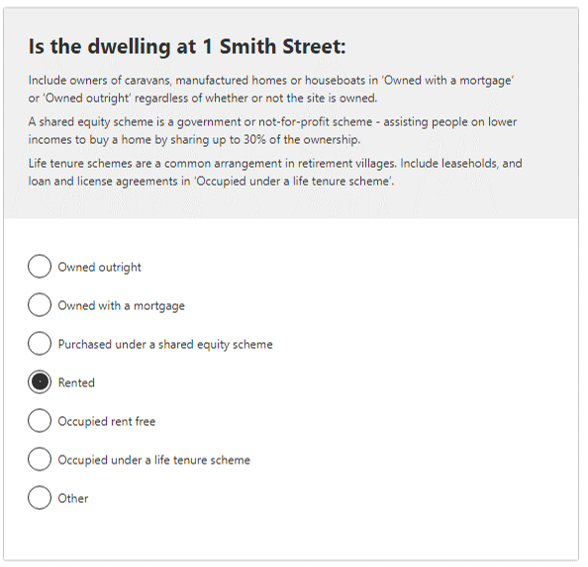

Image

Description

Example

Image

Description

Example

Image

This variable records the mortgage repayments being paid by a household in ranges. It is applicable to occupied private dwellings on Census Night. A private dwelling is defined in Dwelling structure (STRD) and can include caravans in caravan parks, occupied tents, and houseboats.

For practical purposes this information is recoded to a specific number of ranges for standard Census products (such as QuickStats and Community Profiles).

The Census also collects this information in single dollar values (MRED).

Occupied private dwellings that are owned with a mortgage (including being purchased under a shared equity scheme)

| Code | Category |

|---|---|

| 01 | Nil repayments |

| 02 | $1-$149 |

| 03 | $150-$299 |

| 04 | $300-$449 |

| 05 | $450-$599 |

| 06 | $600-$799 |

| 07 | $800-$999 |

| 08 | $1,000-$1,199 |

| 09 | $1,200-$1,399 |

| 10 | $1,400-$1,599 |

| 11 | $1,600-$1,799 |

| 12 | $1,800-$1,999 |

| 13 | $2,000-$2,199 |

| 14 | $2,200-$2,399 |

| 15 | $2,400-$2,599 |

| 16 | $2,600-$2,799 |

| 17 | $2,800-$2,999 |

| 18 | $3,000-$3,499 |

| 19 | $3,500-$3,999 |

| 20 | $4,000-$4,999 |

| 21 | $5,000 and over |

| && | Not stated |

| @@ | Not applicable |

Number of categories: 23

Not applicable (@@) category comprises:

Data for this variable is derived from the Tenure type and Housing costs questions on the Census form. Household repayments data is automatically captured from numeric text responses.

The question relating to Mortgage repayments (monthly) dollar values was first asked for the 1976 Census, though in some previous years this variable has been referred to as ‘Housing loan repayments (monthly)’. Since 2011, Nil repayments is recorded as $0 in Mortgage repayments (monthly) dollar values and as a separate category called ‘Nil repayments’ in Mortgage repayments (monthly) ranges. Prior to 2011 a response of nil was coded as ‘Not Stated’.

No changes have been made for 2021.

The data in these variables is important for the analysis of home ownership and for providing benchmark data for evaluating housing needs, housing finance and housing demand.

Processing Mortgage repayments (monthly) dollar values is subject to some recognition error for responses provided on paper Census forms, particularly when responses incorrectly include cents and the decimal point is missing or unclear. Some high or low values when combined with income may form unlikely combinations. While the data is subject to data assurance checks to ensure an acceptable level of quality, numeric responses are accepted as reported by the respondents on the form.

This variable is derived from Mortgage repayments (monthly) dollar values (MRED). The non-response rate for Mortgage repayments (monthly) dollar values (MRED) was 6.0% in 2021. This is an increase from 4.2% in 2016.