Earnings

Earnings guide

See our Earnings guide for summary information on our range of earnings data. It complements the detailed conceptual information in this Earnings chapter of Labour Statistics: Concepts, Sources and Methods by providing practical guidance on our different earnings measures, their purpose and how to use them.

Statistics of employee remuneration are required for the planning, evaluation and monitoring of economic and social development. Demand for these statistics comes from governments, social and labour market analysts, industrial tribunals, trade unions, employer associations, academics and international agencies.

Comprehensive statistics on remuneration, classified by sex, occupation, skill, industry etc., are in demand because of the role they play in the evaluation of social welfare, taxation, monetary, wage fixation, inflation and prices policies; investment decisions; studies of corporate and international competitiveness; and measurement of living standards.

In recognition of the variety of needs for data in this area, the 12th International Conference of Labour Statisticians (ICLS) in 1973 recommended that countries collect a range of interrelated wages statistics to meet users' differing needs. More information on wages statistics can also be found in An integrated system of wages statistics.

The ABS produces a range of statistics relating to the remuneration of employees in return for work done. These statistics have been developed to meet the various needs of users for information on the returns to labour from economic production, the contribution of employee income to total household income, and the level and distribution of weekly earnings.

The remuneration paid to employees for their work is of interest from both social and economic perspectives, in terms of the income received by employees and the cost of labour for employers. The measures produced include compensation of employees in the quarterly national accounts, employee income in income distribution statistics, average weekly earnings series and the Wage Price Indexes.

The first section of this chapter outlines international concepts of labour costs, compensation of employees, earnings, and household (and employee) income. The rest of this chapter outlines the definitions associated with various ABS statistics of employee remuneration; measures and classifications associated with these statistics; and sources of Australian statistics, including non-ABS series.

Concepts and international guidelines

International standards and guidelines provide the broad principles behind ABS statistics of employee remuneration, ensuring comparability with those of other countries that use the standards. However, the international standards are very general, and need to be interpreted in the context of each country's own situation.

This section outlines the international guidelines in the four main areas of interest, namely:

- costs incurred by employers as a consequence of employing labour;

- the compilation of the national accounting aggregate compensation of employees;

- the measurement of earnings received by employees in exchange for their labour; and

- the measurement of household and employee income.

Labour costs

Labour costs are defined as:

"...remuneration for work performed, payments in respect of time paid for but not worked, bonuses and gratuities, the cost of food, drink and other payments in kind, cost of workers' housing borne by employers, employers' social security expenditures, cost to the employer for vocational training, welfare services and miscellaneous items, such as transport of workers, work clothes and recruitment together with taxes..."

International Labour Organisation, 11th ICLS, 1966

The statistical measure of labour costs is based on the concept of labour as a cost to the employer in the employment of labour, and relates to: all cash and in-kind payments of wage and salaries to employees; all contributions by employers in respect of their employees to social security, private pension, casualty insurance, life insurance and similar schemes; and all other costs borne by employers in the employment of labour that are not related to employee compensation (such as costs of training, welfare services to employees, payroll taxes etc.). Measures of labour cost should be net of any subsidies, rebates or allowances from governments for wage and salary payments to employees, or for other labour costs borne by employers.

Compensation of employees

The System of National Accounts 2008 (2008 SNA) provides the statistical framework for summarising and analysing economic flows, such as economic production, the income generated by production, the distribution of income among the factors of production, and the use of income through consumption or the acquisition of assets.

The 2008 SNA, produced jointly by the United Nations, International Monetary Fund, World Bank, Commission of the European Communities and the Organisation for Economic Co-operation and Development, has been adopted by the ABS as the conceptual basis for compiling the Australian System of National Accounts (ASNA).

National accounts statistics are measured at the aggregate macro-economic level, and are compiled as aggregations of transactions that occur between units in the various institutional sectors (such as the household sector and the government sector). Although compiled at a macro-economic level, the structure and definitions of the national accounts can also be related to the micro-data collected in household surveys and other data collections.

Compensation of employees concepts and international guidelines

Compensation of employees is defined as:

"...the total remuneration, in cash or in kind, payable by an enterprise to an employee in return for work done by the latter during the accounting period."

United Nations, System of National Accounts 2008

The national accounting aggregate that is of main interest in relation to remuneration of employees is compensation of employees, which measures income earned by employees from their employers for services rendered.

The 2008 SNA partitions compensation of employees into three main components: wages and salaries in cash, wages and salaries in kind, and employers' social contributions.

Wages and salaries in cash

Wages and salaries in cash include wages and salaries paid at regular intervals, together with payments by measured result and piecework payments, allowances for working overtime, for working away from home and similar taxable allowances, pay for annual and other leave for short periods, ad-hoc bonuses and commissions, gratuities and tips received by employees.

Wages and salaries in kind

Employees can also be remunerated in wages and salaries in kind, such as goods or services. The provision of goods and services as part of remuneration may reflect taxation advantages for the employer or employee by avoiding payments in cash, or arrangements where the employer provides free or subsidised accommodation, travel, food, motor vehicles, employee stock options and other goods and services for the private use of employees.

In terms of valuing the in-kind payments, the 2008 SNA recommends: "When the goods or services have been purchased by the employer, they should be valued at purchasers' prices. When produced by the employer, they should be valued at producers' prices. When provided free, the value of the wages and salaries in kind is given by the full value of the goods and services in question. When provided at reduced prices, the value of the wages and salaries in kind is given by the difference between the full value of the goods and services and the amount paid by the employee.”

Employers' social contributions

Employers' social contributions are incurred by employers in order to secure social benefits for their employees. In theory, the contributions are made well in advance of the benefits being paid; for example, there is a time difference between the payment of contributions to a superannuation fund and the receipt of superannuation benefits by retired employees. In the national accounts, entitlements to social benefits are generally dependent on certain events or circumstances occurring, such as sickness, accidents, redundancy or retirement. Contributions are treated as part of remuneration, while the benefits are treated as part of households' secondary income. The treatment is largely analogous to the payment of premiums and the receipt of claims with respect to insurance transactions.

Compensation of employees concept as applied in Australia

In the ASNA, the same basic framework as presented in 2008 SNA is used. However, for measurement reasons, there are differences between the conceptual ideal presented above and the actual estimates compiled within the ASNA. The differences relate to severance, termination and redundancy payments, sick leave and other leave payments (except annual and long service leave payments), and changes in provisions for future employee entitlements.

Severance, termination and redundancy payments, sick leave and other leave are types of social benefit payments. There is no separately modelled estimate of the contributions required to provide the benefits, with the actual benefit payments in any period used to estimate the contributions. It is this amount that is included in compensation of employees. Although some information has been collected in the past to separately identify severance, termination and redundancy payments from other wages and salaries, currently no information is available to consistently differentiate between these types of payments and other wage and salary payments. Consequently, the imputed contributions that relate to these benefits are included in wages and salaries in cash, rather than in employers' social contributions.

Under full accrual accounting the estimate of the remuneration of employees would be based on the change in the level of outstanding entitlements to remuneration, particularly with respect to annual, sick and long service leave. While the ASNA would ideally use information on a full accruals basis, a reasonably large proportion of the data collected with respect to wages and salaries is on a cash basis, and hence the ASNA does not fully account for the changes in provisions as required by the international standards.

Treatment of shares and share options

Wages and salaries paid in kind covers the cost of goods and services which are provided to the employee, or to another member of the employee's household, free of charge or at a substantial discount, and which are clearly of benefit to the employee as a consumer. This includes stock options paid as bonuses, redundancy packages or annual salary agreements.

The value of employee stock options that forms part of compensation is estimated as at the vesting date, which is the date at which the employee becomes entitled to receive shares or exercise an option to buy shares. However, in view of the fact that the entitlement is usually earned progressively over a longer period, the value will be spread over the period from the original grant date to the vesting date. Any change in value between the vesting date and the date of actual exercise of options will not be treated as employee compensation, but as a capital gain or loss.

Earnings

The integrated system of wages statistics, developed by the International Labour Organization (ILO) as a result of the 12th ICLS in 1973, sets out the international standards for the concepts, definitions and classifications used in the collection and compilation of statistics of wage rates, earnings and labour costs. More recent international statistical standards, including the 2008 SNA and the 17th ICLS resolution on household income statistics, have remained consistent, as far as possible, with the ILO's integrated system of wages statistics.

The system of wages statistics is designed to meet the needs for information on the levels and movements in average earnings, and on distribution of earnings and hours for different employee types.

Earnings concepts and international guidelines

The statistical measure from the integrated system of wages statistics of main interest in measuring remuneration of employees is 'earnings'. Earnings statistics are based on the concept of wages and salaries as income to the employee. The concept broadly aligns with the wages and salaries component of compensation of employees in the 2008 SNA. However, whereas the national accounts measures wages and salaries as an economic flow over an annual or quarterly period, earnings statistics are generally a series of 'point-in-time' measures of the average earnings of employees in a short reference period. As a result, the definition of earnings is slightly narrower than the national accounts definition of wages and salaries. It refers to remuneration paid 'as a rule at regular intervals', to differentiate between earnings that can be expected to be received regularly (e.g. annually, quarterly or fortnightly) and one-off payments.

International guidelines for wages statistics define earnings as:

"…remuneration in cash and in kind paid to employees, as a rule at regular intervals, for time worked or work done together with remuneration for time not worked such as for annual vacation, other paid leave or holidays. Earnings exclude employers' contributions in respect of their employees paid to social security and pension schemes and also the benefits received by employees under these schemes. Earnings also exclude severance and termination pay.

Statistics of earnings should relate to employees' gross remuneration, i.e. the total before any deductions are made by the employer in respect of taxes, contributions of employees to social security and pension schemes, life insurance premiums, union dues and other obligations of employees."

International Labour Organization, 12th ICLS, 1973

The ICLS guidelines state that the value of wages and salaries in kind should be the value directly accruing to the employee (rather than the cost to the employer). In other words, the value should reflect what it would cost the employee to purchase the goods or services themselves. As individuals are generally only able to purchase goods and services at retail prices, it is appropriate to value wages and salaries in kind at retail prices. However, the guidelines also note that, for employer based surveys, the valuation of wages and salaries in kind depends on whether the employer is supplying its own product (in which case producer prices should be used) or acquiring goods or services to be passed to the employee (in which case purchaser prices should be used).

Earnings concept as applied in Australia

Notionally, the earnings concept used in Australia is consistent with the international concept, although in operationalising the concept in surveys of employers, measures of earnings generally excluded wages and salaries in kind prior to 2006, largely due to practical considerations. Information on the value of benefits provided by the employer has not always been readily available from employer payrolls, and the contribution of wages and salaries in kind to total employee earnings was relatively insignificant when most of the relevant surveys were first established.

However, as a result of changes in the nature of employee remuneration arrangements in recent years, in particular the increasing use of salary sacrifice arrangements, the ABS reviewed the conceptual basis of remuneration statistics in late 2006. The key change to the conceptual basis following on from this review is that the value of goods and services obtained through salary sacrifice arrangements, i.e. where the employee has chosen to forgo wages and salaries in cash in order to receive the goods or services, are now included conceptually in wages and salaries in cash. Wages and salaries in kind will continue to be excluded from earnings measures. For further information, see Information Paper: Changes to ABS Measures of Employee Remuneration.

Household income

Statistics on household income at the aggregated macro-economic level are described within the 2008 SNA. Total gross household sector income is the income accruing to the household sector from production (principally compensation of employees, which is of main interest in analysing remuneration issues) and from property income (such as interest and dividends), together with current transfers from other sectors.

In addition to forming sector level aggregates, statistics on household income can be compiled from the perspective of measuring the economic well-being of individuals and households, in terms of the distribution of income across households and individuals for various population subgroups of interest.

Household income concepts and international guidelines

International guidelines for the measurement of household income were revised in 2003 at the 17th International Conference of Labour Statisticians (ICLS), an expert group convened by the ILO. The guidelines were developed for the purposes of measuring income distribution on a comparable basis internationally, and for the collection and dissemination of household income statistics at aggregate and micro-data levels that are consistent, to the extent possible, with other international guidelines, including SNA93.

In the ICLS guidelines the concept of household income consists of all receipts, whether monetary or in kind (goods and services), that are received by the household or by individual members at annual or more frequent intervals, but excludes windfall gains and other such irregular and typically one-time receipts. Household income receipts are available for current consumption and do not reduce the net worth of the household through a reduction of its cash, the disposal of its other financial or non-financial assets, or an increase in its liabilities.

The 2003 ICLS guidelines include definitions for the components of household income. The component 'employee income' is defined to be broadly comparable with the definition of compensation of employees in the 2008 SNA.

Employee income concepts and international guidelines

Guidelines for household income statistics define employee income as comprising:

"...direct wages and salaries for time worked and work done, cash bonuses and gratuities, commissions and tips, directors’ fees, profit-sharing bonuses and other forms of profit-related pay, remuneration for time not worked as well as free or subsidised goods and services from an employer. It may include severance and termination pay as well as employers' social contributions."

International Labour Organization, 17th ICLS, 2003

The flexibility in the ICLS definition of employee income regarding both severance and termination pay and employers' social contributions can give rise to two situations where employee income will not be consistent with the 2008 SNA definition of compensation of employees. Firstly, compensation of employees includes employers' social contributions, so if the option to exclude them from employee income is exercised then a difference arises between the two measures. Secondly, provision for severance and termination pay is classified in SNA93 as part of employers' social contributions, and SNA93 provides practical advice that these provisions can be approximated by the actual payments occurring in a reference period. Exercising the option to include the actual severance and termination payments in employee income, when the provision for them is not included as part of employers' social contributions within employee income, will reduce the difference between employee income and compensation of employees.

The 2003 ICLS guidelines value employee income in kind at relevant market prices (producer or basic prices) for equivalent goods and services, in line with SNA93 recommendations. Market prices include transport costs, taxes and subsidies. Where the employee income in kind consists of the outputs of the employer’s production processes, and is 'imposed payments in-kind' with little or no market value, a zero value is applied in computing employee income.

Employee income concept as applied in Australia

In the dissemination of household income statistics, the ABS defines the employee component of income to include regular and recurring cash receipts from wages and salaries.

The severance and termination payments and other employers' social contributions, which are part of compensation of employees in the ASNA, are excluded from Australian household income statistics. In addition, the concept of employee income differs from the ASNA concept of wages and salaries by excluding income in kind, which includes employee benefits such as the provision of a house or a car.

Restricting measurement of employee income to regular and recurring wages and salaries in a 'current income' concept was intended to provide a measure of the income that was currently available to the household to support their living standards, and the income that was likely to be available in the near future. That is, in looking at weekly income at the household level, a one-off payment received during the survey reference period was not included in measures of household income as it was not ongoing income.

The exclusion of income in kind was largely an historical issue arising from the impracticality of reliable reporting by householders for the value of income in kind, and reflected an expectation that the amounts would not be so significant as to affect distributional analysis at the household level. Changes in aggregate household income, inclusive of such in-kind income over time, would be reflected in the national accounts concept.

Employee remuneration conceptual framework

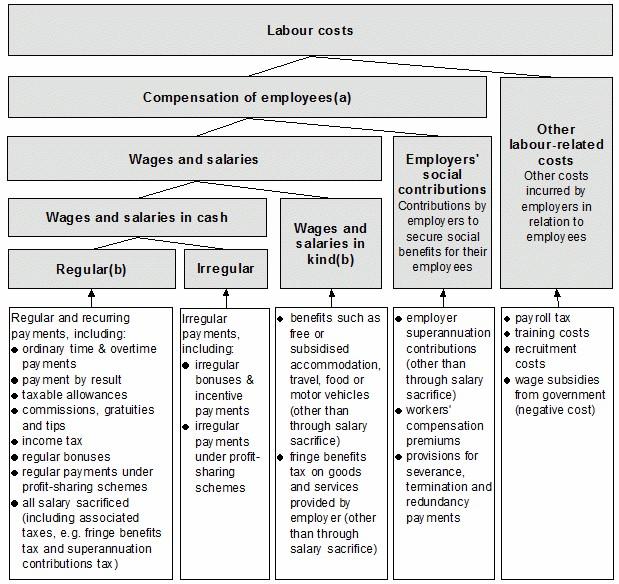

The diagram below summarises the conceptual framework for statistical measures of employee remuneration in Australia (in the context of the broader concept of labour costs). The narrowest concept outlined in the international guidelines is that of 'Earnings'. Concepts of 'Wages and salaries', 'Employee income', 'Compensation of Employees' and 'Labour costs' all include and extend upon the concept of 'Earnings'.

Australian conceptual framework for measures of employee remuneration

Image

Description

- The concept 'employee income' is broadly comparable with compensation of employees.

- Conceptually, earnings comprise regular wages and salaries in cash and regular wages and salaries in kind.

ABS data sources

The ABS produces earnings statistics, as well as earnings related measures, from a range of sources.

Household surveys provide:

- earnings by socio-demographic characteristics;

- earnings by a range of employment characteristics, such as paid leave entitlements; and

- greater geographic information about place of usual residence including Statistical Area level 4 under the Australian Statistical Geography Standard.

However, limitations of household surveys data include:

- earnings are less robust, with reliance on respondents' accurate recall of (pre-tax) earnings;

- some respondents report on behalf of others in the household which can affect the quality of data reported;

- fewer and less robust information about business characteristics; and

- components of earnings estimates not available.

Employer surveys provide:

- more accurately reported earnings as data are obtained from employers' payrolls;

- components of earnings collected separately (i.e. ordinary time and overtime earnings); and

- consistent business characteristics (such as industry and business size), as this information is maintained on the ABS Business Register.

However limitations of employer surveys data include:

- limited socio-demographic characteristics of employees;

- limited information about characteristics of employment; and

- only state/territory geographic information about place of work available.

Administrative data sources provide:

- monthly and annual change in the wages and salaries paid by employers;

- change in wages and salaries by industry and state and territories; and

- public sector employees wages and salaries by level of government, state and territories and industries.

However limitations of administrative data include:

- differences in coverage, definition and quality compared to survey based outputs.

Our Earnings guide provides summary information on our various earnings measures, their purpose and how to use them.

| Designed to measure | Frequency/Type of data source | Benefits | Primary publication | |

|---|---|---|---|---|

| Average Weekly Earnings | The level of average weekly earnings of employees. | Biannual business survey. | Time series data available (including seasonally adjusted and trend estimates). | Average Weekly Earnings. Australia. |

| Census | Total personal income collected in ranges. Household and family income imputed from personal income. | Population census conducted every 5 years. | Data available for small geographic areas. | Data available from ABS website (TableBuilder). |

| Characteristics of Employment | Earnings and the distribution of weekly earnings. | Annual household survey conducted in August. | Detailed socio-demographic information and labour force statistics. Distributional data available. | Characteristics of Employment |

| Economic Activity Survey | Earnings and the distribution of weekly earnings. | Annual business survey combined with ATO administrative data (business activity statement). | Time series data available, cross classified by industry divisions and subdivisions. | Australian Industry. |

| Quarterly Business Indicators Survey | Revenue, profits, inventory and wages paid by private sector businesses. | Quarterly business survey. | Time series data available. | Business Indicators, Australia. |

| Survey of Employee Earnings and Hours | Composition and distribution of earnings (weekly and hourly) of employees, hours paid for and whether their pay is set by award, collective agreement or individual arrangement. | Biennial business survey with payroll employee component. | Data cross-classified by employer and some employee characteristics. Distributional data available. | Employee Earnings and Hours. Australia. |

| Survey of Income and Housing | A breakdown of household income, including wages and salaries. | Two-yearly household survey. | Distributional data on the broader context of household income and components available (including labour income) cross-classified by several employee characteristics. | Household Income and Income Distribution. Australia. |

| Survey of Major Labour Costs | Total earnings as well as other labour costs borne by businesses, for example payroll tax. | Irregular business survey. | Earnings data in the broader context of labour costs. Data per employee also available. | Labour Costs, Australia. |

| Wage Price Index | Changes in the price of wages and salaries resulting from market pressures. | Quarterly business survey. | Estimate of pure wage inflation removing the effect of composition. | Wage Prices Index, Australia. |

| Employee Earnings and Jobs | Experimental employee earnings estimates using administrative data. | First publication using data from an experimental linked employer-employee database (LEED). | Demonstrates the feasibility linking employer and employee information to inform labour supply and labour demand and to provide a high quality job count. | Information Paper: Construction of Experimental Statistics on Employee Earnings and Jobs from Administrative Data. Australia. |

| Personal Income in Australia | Regional estimates of employment and total income for persons who lodge a tax form, using data sourced from the Australian Tax Office (ATO). | Annual analysis of ATO administrative data (personal income tax). | Data for small areas, down to Local Government Area level. | Personal Income in Australia. |

| Monthly Employee Earnings Indicator | Monthly and annual percentage change in wages and salaries paid to employees by employers. | Six-monthly data sourced from Single Touch Payroll (STP). | Estimate of wages and salaries for all employing businesses and organisations in the Australian economy. | Monthly Employee Earnings Indicator. |

| Public Sector Employment and Earnings | Public sector employee earnings paid by level of Government. | Annual data sourced from Single Touch Payroll (STP). | Public sector estimates, by level of government. | Public Sector Employment and Earnings. |

Earnings

Estimates of earnings are produced from a number of ABS surveys and include measures of average weekly earnings, earnings distributions and earnings composition. The definition of earnings, and the measures produced, varies between surveys as discussed below.

The key ABS collections producing earnings statistics are:

- the biannual (six-monthly) survey of Average Weekly Earnings (AWE)

- the biennial (two-yearly) survey of Employee Earnings and Hours (EEH)

- the annual survey of Characteristics of Employment (COE)

In the first two surveys (which are employer based), the measure of earnings relates to a short reference period (e.g. a pay period), and is restricted to cash wages and salaries that are received regularly and frequently. The measure of earnings includes, for practical reasons, employer payments for sick leave (conceptually part of employers' social contributions in 2008 SNA).

The measure of earnings used in the COE survey (which is a household survey) relates to the most recent pay; that is, the last total pay before tax or any other deductions. It also includes irregular and infrequent payments, and payments related to other periods. This is for practical reasons only.

Estimates of earnings are also produced from the Public Sector Employment and Earnings (PSEE) and the Survey of Major Labour Costs (MLC); however, these collections use a broader definition.

Monthly Employee Earnings Indicator also produces a measure of changes in wages and salaries paid by employers.

Survey of Average Weekly Earnings

The AWE survey measures regular wages and salaries in cash associated with employee jobs. Estimates of average weekly earnings, and changes in average weekly earnings, are published twice yearly (in respect of the May and November quarters). The definition used in the AWE survey aligns closely with the international definition of earnings.

The earnings measure collected in the AWE survey is limited to:

- remuneration for time worked or work done - ordinary time and overtime pay, penalty payments, commissions (where a retainer, wage/salary is also paid), taxable allowances (e.g. shift, site, dirt, height allowances), incentive and piecework payments, directors salaries;

- remuneration for time not worked - including paid leave and public holidays, and workers compensation payments paid through the payroll; and

- bonuses and gratuities - includes regular and frequent bonuses only (e.g. weekly, fortnightly or quarterly), and regular payments made under profit sharing schemes.

The following components of remuneration are excluded from AWE earnings measures:

- wages and salaries in kind;

- amounts salary sacrificed; and

- all other payments that are irregular or are not related to the survey reference period - including retrospective pay and pay in advance, severance, termination and redundancy payments; leave loadings; and half-yearly, annual or irregular bonuses.

In addition, estimates which are inclusive of salary sacrifice are now compiled from the AWE survey. The Average Weekly Cash Earnings (AWCE) series are available in respect of the May 2010 quarter onwards. The new AWCE series complement (rather than replace) the existing series by providing estimates of average weekly earnings which include salary sacrificed earnings.

Estimates of average weekly earnings are derived by dividing estimates of gross weekly earnings by estimates of number of employees. These measures do not relate to the earnings of the 'average employee'.

Changes in the average may be affected not only by changes in the underlying rates of pay, but also by changes in the weekly hours worked (or paid for) and by changes in the composition of jobs in the workforce. Compositional changes can be the result of variations in the proportion of full-time, part-time, casual, adult and junior employees, variations in the occupational distribution within and across industries, variations in the distribution of employees between industries, and variations in the proportion of male and female employees.

The AWE survey produces a range of estimates of average weekly earnings paid per employee job. The following estimates are produced: average weekly ordinary time earnings for full-time adults; average weekly total earnings for full-time adults; and average weekly total earnings for all employee jobs (i.e. whether full-time or part-time, or whether paid at adult or junior rates). These estimates can be classified by sex, sector, industry and state/territory.

Survey of Employee Earnings and Hours

The biennial Survey of Employee Earnings and Hours (EEH) measures regular wages and salaries in cash associated with employee jobs. The EEH survey produces estimates of earnings distributions, and average weekly and hourly cash earnings classifiable by sex, rate of pay, managerial/non-managerial status, full-time/part-time status, hours paid for, components of pay, occupation, industry, sector, state/territory, and method of setting pay.

From the 2006 EEH survey onwards, earnings measures include amounts salary sacrificed.

The components of earnings available from the EEH survey are ordinary time cash earnings and overtime cash earnings. Ordinary time cash earnings relates to payment for award, standard or agreed hours of work, including allowances, penalty payments, payment by measured result, regular and frequent bonuses and commissions (where a retainer/wage/salary is also paid). Overtime cash earnings relates to payment for hours in excess of award, standard or agreed hours of work.

The EEH survey also produces estimates of average hourly total cash earnings for non-managerial employees, classified by male/female, permanent/fixed-term contract/casual, state/territory, and method of setting pay.

Characteristics of Employment Survey

Earnings measures used in the annual Characteristics of Employment (COE) household survey relate to gross payments received from either the main job or all jobs during the reference period. No adjustments are made to exclude components of pay that are outside the international earnings definition, such as irregular bonuses, and components of pay that do not relate to the reference period (such as retrospective pay and pay in advance). Earnings measures produced from COE are restricted to cash earnings, i.e. they exclude contributing family workers.

The COE survey produces estimates of mean and median weekly earnings per employee. Estimates of mean weekly earnings of employees are derived by dividing estimates of gross weekly earnings by estimates of the number of employees. Mean weekly earnings represent the average gross (before tax) earnings of employees. Median weekly earnings are defined as the earnings amount which divides the earnings distribution into two groups with equal numbers of employees, one half having weekly earnings below the median and the other half having weekly earnings above the median.

Separate estimates are produced for earnings in main, second and all jobs held by employees; and earnings distributions. Estimates are produced for both main job and all jobs, classifiable by a range of socio-demographic and economic variables including age, birthplace, sex, relationship in household, state/territory of usual residence, industry, occupation, sector, full-time/part-time status and hours worked.

Employment and Earnings and Survey of Major Labour Costs

Earnings statistics are also produced from the administrative data collection Public Sector Employment and Earnings (PSEE) and the Survey of Major Labour Costs (MLC). However, unlike the AWE, EEH and COE surveys, PSEE and MLC are not designed to produce estimates of the concept of earnings per se, but estimates which align with the broader concepts of wages and salaries, compensation of employees or labour costs. As such, PSEE and MLC define earnings more broadly than in the AWE and EEH surveys, and estimates are not comparable across surveys.

The definition used in PSEE and MLC extends upon the definition of earnings by also including irregular payments (such as irregular bonuses) and other payments which may not relate to the reference period (such as pay in advance and retrospective pay). MLC also includes severance, termination and redundancy payments, and all fees paid to directors and office holders. Separate estimates of severance, termination and redundancy payments are also available from PSEE.

Estimates from PSEE and MLC are primarily used in the production of estimates of compensation of employees within the Australian National Accounts. Unlike the AWE and EEH surveys, which are designed to estimate average earnings levels at a point in time, the PSEE administrative collection and the MLC surveys are both designed to estimate earnings flows to employees over a financial year.

Compensation of employees

The remuneration earned by employees for labour services rendered is measured in the Australian National Accounts aggregate ‘compensation of employees’. The compensation of employees measure comprises wages and salaries in cash or in kind, and the value of employer's social contributions for their employees.

The key sources used in compiling estimates of compensation of employees are:

- the Economic Activity Survey (EAS);

- the Quarterly Business Indicators Surveys (QBIS); and

- Public Sector Employment and Earnings.

Data from the infrequent MLC survey are also used to provide benchmark information. A more detailed description of the concepts, sources and methods used to compile the national accounts is presented in Australian System of National Accounts: Concepts, Sources and Methods. Estimates of compensation of employees are contained within the Income Accounts of the Australian National Accounts, which are published in Australian System of National Accounts, and Australian National Accounts: National Income, Expenditure and Product.

Labour costs

Estimates of labour costs are produced from the MLC, and the annual Economic Activity Survey.

Estimates of the underlying changes in the price of labour (indexes of changes in hourly labour costs for employee jobs) are produced from the Wage Price Index.

Survey of Major Labour Costs

The measure of labour costs available from the MLC survey relates to the main costs incurred by employers as a consequence of employing labour. The labour cost components collected in the MLC survey are:

- Employee earnings;

- Superannuation;

- Payroll tax;

- Workers' compensation; and

- Fringe Benefits Tax.

A number of labour costs are not collected in the MLC Survey. These include: training costs; costs associated with employee welfare services; and recruitment costs. With the exception of training costs, these items are not considered to make a significant contribution to total labour costs. Training costs were collected in the ABS Training Expenditure and Practices Survey, conducted for financial year 2001-02, and in the earlier Training Expenditure Survey conducted for September quarters of 1989, 1990, 1993 and 1996. Costs covered in these surveys are for structured training provided by employers. For information see Employer Training Expenditure and Practices, Australia.

All data are collected on a cash basis, i.e. they reflect actual payments made in the survey reference period. As such, they do not reflect costs incurred in the reference period for which payments are made in a later period, but they include payments made in the survey reference period for costs incurred in a prior period. The survey has a 12 month (financial year) reference period and is conducted on an infrequent basis.

Estimates of total labour costs and costs per employee job can be cross classified by state/territory, industry, sector, level of government and employer size.

Earnings

As discussed above, the definition of earnings used in the MLC is broader than that used in the AWE, EEH and COE surveys.

Superannuation

For the MLC survey, superannuation costs are the total employer superannuation contributions paid during the year on behalf of employees. It excludes the value of salary sacrificed by employees in exchange for superannuation contributions. During 2002-03, legislation underlying the Superannuation Guarantee Charge (SGC) required that employers provide superannuation contributions of at least 9% of gross wages and salaries for all eligible employees. Although employers may treat the value of salary sacrificed by employees to superannuation as employer contributions under SGC obligations, in this survey such contributions are treated as earnings, and not as superannuation costs. Occasionally, surplus funds of some defined benefit superannuation schemes are used to offset the superannuation cost incurred by contributing employers in a particular time period.

Payroll tax

Payroll tax is defined as the amount of tax paid during the survey reference year in respect of employee earnings, net of any rebates. Payroll tax assessed for payments to contractors and other persons not considered employees is excluded.

Workers' compensation

Workers’ compensation is the cost to the employer of providing workers’ compensation cover for employees. There are three ways to meet these costs. The majority of employers pay a premium to an insurer. In this case, workers’ compensation costs are considered to comprise premiums paid during the reference year, including the component that covers the employee for common law damages, and any workers’ compensation costs not reimbursed by the insurer, including ‘make-up’ and ‘excess’ pay.

Some larger employers may become ‘self-insurers’ and cover most costs themselves. In this case, workers’ compensation costs are considered to comprise lump sum payments and payments made as part of employee earnings, premiums paid during the year to offset liability at common law for workers’ compensation, and any other costs, including common law costs not reimbursed by the insurer, such as legal, accounting, medical and administrative costs.

In the public sector, some workers’ compensation costs are paid from consolidated funds. In most cases these payments relate to liabilities incurred under prior legislation.

Fringe Benefits Tax

Fringe benefits are remuneration provided to employees in the form of benefits such as goods or services - for example, use of a work car, a cheap loan, or health insurance costs. These may be provided through salary sacrifice arrangements, as part of salary packages, or through other arrangements. Fringe benefits tax (FBT) is payable on the value of benefits provided, although exemptions apply to some categories of employers (e.g. certain not-for-profit organisations) and certain benefits (e.g. laptop computers).

Australian Industry

Estimates of labour costs from the Australian Industry series are derived using a combination of data from the annual ABS Economic Activity Survey (EAS) and business income tax data provided by the Australian Taxation Office. This series defines labour costs more narrowly than the MLC survey. Labour costs are restricted to: wages and salaries paid to employees; employer contributions to superannuation; and workers' compensation. Severance, termination, and redundancy payments are included in wages and salaries. For further information on data content and collection methodology of this series, see Australian Industry.

Wage Price Index

The quarterly Wage Price Index (WPI) measures the quarterly change in the price employers pay for labour due to market factors. The WPI is unaffected by changes in the quality or quantity of work performed; that is, it is unaffected by changes in the composition of the labour force, hours worked, or changes in characteristics of employees (e.g. work performance).

Wage Price Indexes (WPIs) were first produced by the ABS in the December quarter 1997. In the September quarter 2004, the inclusion of non-wage indexes complimented the existing suite of WPIs, and combined with WPIs to create Wage Price Indexes (LPIs). In March 2012, ABS program reductions led to the non-wage and LPI indexes being discontinued, with the September quarter 2011 representing the last in the series.

The ABS constructs four wage price indexes on a quarterly basis:

- ordinary time hourly rates of pay excluding bonuses;

- ordinary time hourly rates of pay including bonuses;

- total hourly rates of pay excluding bonuses; and

- total hourly rates of pay including bonuses.

For further information, see Wage Price Index: Concepts, Sources and Methods.

Employee income

Employee income is defined as "regular and recurring cash receipts from wages and salaries". Employee income includes: wages and salaries; tips, commissions and regular bonuses; other profit-sharing bonuses; piecework payments; payment for recurring odd jobs, casual work; penalty payments and shift allowances; directors' fees; remuneration for time not worked (e.g. holiday pay, sick pay, pay for public and other holidays, and other paid leave); worker's compensation paid by the employer; and leave loadings.

Employee income excludes severance or termination pay, allowances paid by an employer purely to cover the cost of work-related expenses, and pension payments from unfunded schemes paid to former employees.

Measures of employee income are available from a number of ABS household collections including:

- the Survey of Income and Housing;

- the Household Expenditure Survey; and

- the Census of Population and Housing.

Survey of Income and Housing

The Survey of Income and Housing is a two-yearly survey that collects detailed information on employee income. For detail on the content and methodology of the survey, see Household Income and Wealth, Australia.

Household Expenditure Survey

The Household Expenditure Survey (HES) also collects detailed information on employee income. Some information is collected on income in kind (namely consumable goods provided by employers). For more detail on the content and methodology of the survey, see Household Expenditure Survey, Australia: Summary of Results.

Census of Population and Housing

The Census of Population and Housing collects information on total income levels (ranges) only. Estimates cannot be classified according to type of income. For more detail on the content and methodology of the Census, refer to the Household surveys section.

Linked Employer-Employee Dataset

Employee Income is available from the LEED. Information is available commencing from the 2011-12 financial year and is available down to micro-regional levels. Key statistics are published in Personal Income in Australia.