- See SNA, 2008, para.4.92 for more detail about the degree of control by government.

Institutional sectors

4.47 The institutional sectors of 2008 SNA group together similar kinds of institutional units. Corporations, NPIs, government units and households are intrinsically different from each other in that their economic objectives, functions and behaviour are different. Institutional units are allocated to a sector according to the nature of the economic activities they undertake. The three basic economic activities recorded in 2008 SNA are production of goods and services, consumption to satisfy human wants or needs, and accumulation of various forms of capital.

4.48 2008 SNA groups institutional units with similar functions into the following institutional sectors:

- the non-financial corporations sector;

- the financial corporations sector;

- the general government sector;

- the household sector; and

- the non-profit institutions serving households sector.

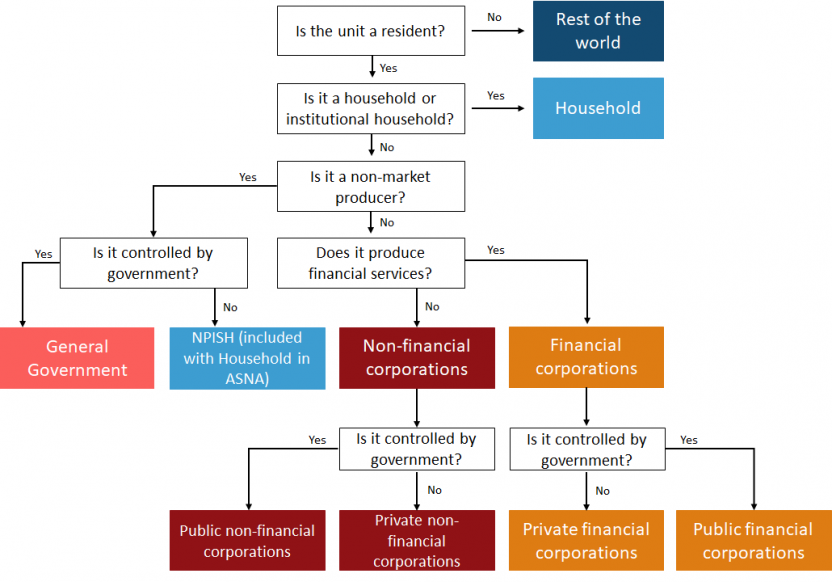

4.49 The figure below shows the 2008 SNA allocation of types of institutional units to institutional sectors. The same allocation rules are followed in the ASNA; however, the NPISH sector is consolidated within the household sector in the Australian System of National Accounts.

Figure 4.2 Illustrative allocation of institutional units to institutional sectors

4.50 The sectors of the total economy and the rest of the world are highlighted. Once non-resident units and households are set aside, only resident legal and social entities remain. Three questions determine the sectoral allocation of all such units. The first is whether the unit is a market or non-market producer. This depends on whether most of the unit’s production is offered at economically significant prices or not.

4.51 The second question determining sectoral allocation applies to non-market units, all of which, including non-market NPIs, are allocated either to general government or to the NPISH sector. The determining factor for sectoral allocation is whether a non-market unit is part of, or controlled by, government.

4.52 The third question determining sectoral allocation applies to market units, all of which, including market NPIs, are allocated to either the non-financial corporations sector or the financial corporations sector.

Non-financial corporations sector

4.53 The non-financial corporations sector consists of all resident corporations, notional institutional units and quasi-corporations that are principally engaged in the production of market goods and/or non-financial services, and holding companies with mainly non-financial corporations as subsidiaries. It includes:

- resident non-financial corporations irrespective of the residence of their shareholders;

- quasi-corporations (including branches of foreign owned non-financial enterprises that are engaged in significant production in the economic territory on a long-term basis);

- non-profit institutions that are market producers of goods or non-financial services; and

- investment funds investing in predominantly non-financial assets such as infrastructure and property.

4.54 2008 SNA identifies three subsectors within the non-financial corporations subsector:

- Public non-financial corporations are resident non-financial corporations or quasi-corporations that are government owned or controlled.

- National private non-financial corporations are resident non-financial corporations or quasi-corporations that are not controlled by government or non-resident institutional units. Market NPIs are included in this subsector.

- Foreign controlled non-financial corporations are resident non-financial corporations or quasi-corporations that are controlled by non-resident institutional units.

4.55 The latter two subsectors are not distinguished in the ASNA. The disaggregation in ASNA is:

- Public non-financial corporations; and

- Private non-financial corporations.

4.56 Public non-financial corporations are further dissected into national and state and local subsectors.

4.57 Private non-financial corporations are further dissected into non-financial investment funds and other private non-financial corporations. The inclusion of non-financial investment funds in the non-financial corporations sector is a departure from 2008 SNA which includes all non-money market investment funds in the financial corporations sector. Non-financial investment funds invest in non-financial assets, usually real estate.

4.58 The ABS publication, Australian National Accounts: Finance and Wealth provides a further sectoral breakdown of non-financial corporations into public and private, with the public sector dissected into national and state and local subsectors, and private sector dissected into non-financial investment funds and other private non-financial corporations.

Financial corporations sector

4.59 The financial corporations sector consists of all resident corporations, notional institutional units, quasi-corporations, and market NPIs that are principally engaged in financial intermediation or in auxiliary financial activities. Financial corporations are distinguished from non-financial corporations because of their different roles in the economy, and the inherent differences in their respective functions and activity. Financial corporations are mainly engaged in financial market transactions, which involve incurring liabilities and acquiring financial assets; that is, borrowing and lending money, providing superannuation, life, health or other insurance, and financial leasing or investing in financial assets. In this process, the corporations are not acting as agents, but rather place themselves at risk by trading in financial markets on their own account. Financial auxiliaries are also classified to the financial corporations sector. They include stockbrokers, insurance brokers, investment advisers, trustees, custodians and nominees, mortgage originators and other entities that are engaged in providing services closely related to financial intermediation, even though they do not intermediate themselves.

4.60 Subsectors of the financial corporations sector identified in ASNA are:

- Central Bank – the Reserve Bank of Australia (RBA).

- Depository corporations – consist of all resident financial corporations and quasi-corporations, except the central bank, that are principally engaged in financial intermediation and have liabilities in the form of deposits or financial instruments that are close substitutes for deposits such as short-term certificates of deposits. This subsector is dissected into:

- Authorised deposit-taking institutions; and

- Other broad money institutions.

- Superannuation funds and insurance corporations – consist of all funds that provide retirement benefits for specific groups of people and all corporations that provide life and other insurance cover, including reinsurance services. This subsector is dissected into:

- Superannuation funds;

- Life insurance corporations; and

- Non-life insurance corporations.

- Financial investment funds – these are collective investment schemes that raise funds by issuing shares or units to the public and the proceeds are invested primarily in financial assets. This subsector is dissected into:

- Money market funds (MMF) – which invest in transferable debt instruments with a residual maturity of no more than one year, bank deposits and instruments that pursue a rate of return that approaches the interest rates of money market instruments; and

- Non-money market financial investment funds (NMMF) – which invest in financial assets other than short-term assets.

- Central Borrowing Authorities (CBAs) – are captive financial institutions established by each State and Territory government to primarily provide finance for public corporations and notional institutional units and other units owned or controlled by the government. They raise funds predominantly by issuing securities, arranging the investment of these unit's surplus funds and participating in the financial management activities of the parent government.

- Securitisers – are financial intermediaries that pool various types of assets such as residential mortgages, commercial property loans and credit card debt, and package them as collateral to issue bonds or short-term debt securities, referred to as asset backed securities.

- Other financial corporations – include other financial intermediaries, financial auxiliaries, money lenders and other captive financial institutions described as follows:

- Other financial intermediaries – includes housing finance schemes established by State and Territory governments; economic development corporations owned by government to fund infrastructure developments;

- Financial auxiliaries – units engaged in activities closely related to financial intermediation, but which do not themselves perform an intermediation role; that is, the auxiliary does not take ownership of the financial assets and liabilities being transacted. The types of corporations included are insurance brokers, loan brokers, investment advisors, managers of superannuation funds, securities brokers, etc.;

- Money lenders – units providing financial services where most of their assets and liabilities are not transacted on the open markets; for example, pawnshops that predominantly engage in lending; and

- Other captive financial institutions – units characterised by having a balance sheet holding financial assets on behalf of other companies. These institutions are usually legal entities such as corporations, trusts or partnerships established for a specific or limited purpose; for example, to hold the assets of a group of subsidiary corporations.

General government sector

4.61 The general government sector consists of government units and non-market NPIs that are controlled by government. The general government sector includes all government departments, offices and other bodies mainly engaged in the production of goods and services outside the normal market mechanism for consumption by government itself and the general public. The units' costs of production are mainly financed from public revenues and they provide goods and services to the general public, or sections of the general public, free of charge or at nominal charges well below costs of production. The sector includes government enterprises mainly engaged in the production of goods and services for other general government units. Also included are NPIs that are serving businesses or households and are composed largely of private sector members but are controlled by governments.

4.62 Subsectors within the general government sector in ASNA are:

- national; and

- state and local.

4.63 Public universities are treated as non-market NPIs controlled by government and are allocated to the general government sector. They are included in the national subsector together with Commonwealth general government.

4.64 Public universities are defined as non-market NPIs based on their funding arrangements. While most public universities were created by State legislation, the bulk of their funding is received from the Commonwealth government. Public universities are allocated to the government sector on the basis that, while no Australian government is able to control universities in the sense of being able to appoint their managing officers, it is clear that the Commonwealth government is able to exercise a significant degree of control through its funding power.

Household sector

4.65 The household sector consists of all resident households, defined as small groups of persons who share accommodation, pool some or all of their income and wealth, and collectively consume goods and services, principally housing and food. Although households are primarily consumers of goods and services, they also engage in other forms of economic activity through their operation of unincorporated enterprises. Such unincorporated enterprises are included in the household sector because the owners of ordinary partnerships and sole proprietorships will frequently combine their business and personal transactions, and complete sets of accounts in respect of the business activity will often not be available.

4.66 The 2008 SNA suggests that the household sector may be divided into subsectors on the basis of the type of income that is the largest source of income for each household or, alternatively, on the basis of other criteria of an economic, socioeconomic or geographical nature. 2008 SNA advises that statistical agencies determine the number and nature of subsectors to suit their own purposes, in view of differing needs across countries in relation to the analysis of the household sector. ASNA does not include any further dissection.

Non-Profit Institutions serving households sector (NPISH)

4.67 All institutional units of a particular type are grouped together within the same sector with the exception of NPIs. They are classified to various sectors depending on the nature of the NPI. Market NPIs are allocated to either the non-financial corporations sector or the financial corporations sector, depending on which sector they serve. Non-market NPIs that are controlled by government units are allocated to the general government sector. For example, an NPI which is mainly financed by government may be controlled by that government. It would not be considered controlled by government if the NPI remains able to determine its policy or programme to a significant extent.³¹ Other non-market NPIs - those not controlled by government - are allocated to the NPISH sector (note again that the NPISH sector has not been separately identified in the ASNA).

4.68 The NPISH sector includes the following two main kinds of NPISHs that provide goods or services to their members or to other households without charge, or at prices that are not economically significant:

- organisations whose primary role is to serve their members, such as trade unions, professional or learned societies, consumers' associations, political parties, churches or religious societies, and social, cultural, recreational and sports clubs; and

- philanthropic organisations, such as charities, relief and aid organisations financed by voluntary transfers in cash, or in kind, from other institutional units.

Rest of the world

4.69 In addition to accounts for the resident sectors, 2008 SNA includes external (rest of the world) accounts, which provide a summary of all transactions of residents with non-residents (e.g. overseas governments, persons and businesses). The rest of the world consists of all non-resident institutional units that enter into transactions with resident units or have other economic links with resident units. It is not a sector for which complete sets of accounts have to be compiled, although it is often convenient to describe the rest of the world as though it were a separate sector.

4.70 As discussed in relation to residence, the rest of the world includes institutional units that may be physically located within the geographical boundary of a country, for example, foreign enclaves such as embassies, consulates or military bases, and international organisations that are not treated as resident institutional units.