One of the key elements of the digital economy that policy makers look to understand is the digital intensity of Australian businesses. The Business Characteristics Survey (BCS) collects and disseminates numerous indicators that describe the adoption and integration of digital technologies and practices by businesses.

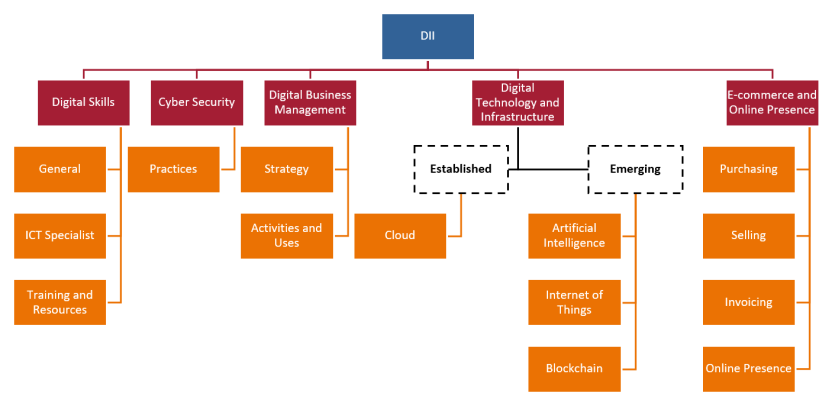

This article presents information on how the ABS has developed an experimental Digital Intensity Index (DII) composite indicator which brings together several metrics into a single measure of business digital intensity.