The Australian Bureau of Statistics (ABS) has been collecting ‘point of sale’ systems data from supermarkets, otherwise known as scanner data, since 2011. The main use of scanner data in the ABS to date has been in the compilation of the Consumer Price Index (CPI). Scanner data has enormous potential for use in official statistics due to its coverage, frequency and granularity; however, to date there has been limited work to develop methods using this data to compile National Accounts.

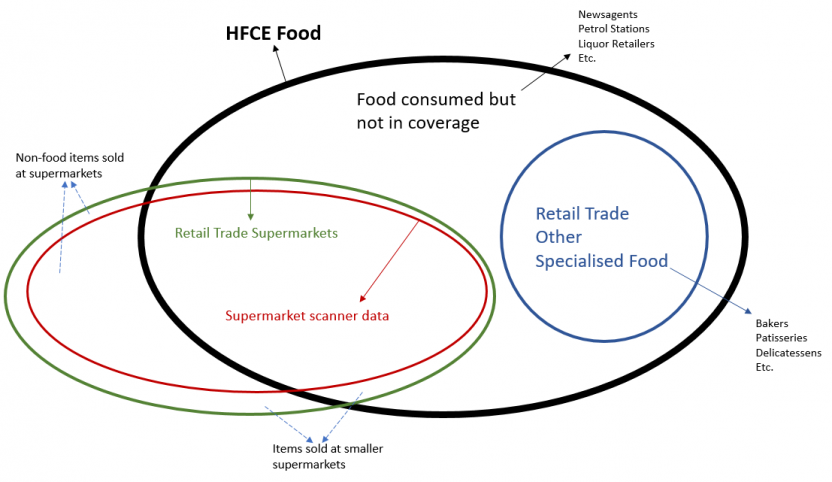

This paper presents recent ABS work using supermarket scanner data to inform food consumption by households. The paper details how supermarket scanner data can be used to produce high quality indicators of household food consumption in both current price and volume terms. Additionally, the paper describes how scanner data can provide additional insights into changes in household food consumption patterns as well as further plans for development in the National Accounts.

Authors: Andy Peisker, Tom Lay and Michael Smedes

National Accounts, Macroeconomic Statistics Division