Articles

This quarter's National Accounts includes the following articles:

Quarterly estimates of key economic flows in Australia, including gross domestic product (GDP), consumption, investment, income and saving

This quarter's National Accounts includes the following articles:

Unless otherwise stated all figures are in seasonally adjusted, chain volume measures.

The reference year for chain volume measures is 2018-19.

For more information about the changes in this issue, please see revisions and changes on this page.

| Sep 19 to Dec 19 | Dec 19 to Mar 20 | Mar 20 to Jun 20 | Jun 20 to Sep 20 | Sep 20 to Dec 20 | Dec 19 to Dec 20 | ||

|---|---|---|---|---|---|---|---|

| Chain volume GDP and related measures (b) | |||||||

| GDP | 0.4 | -0.3 | -7.0 | 3.4 | 3.1 | -1.1 | |

| GDP per capita (c) | 0.1 | -0.6 | -7.2 | 3.3 | 3.0 | -1.8 | |

| Gross value added market sector (d) | 0.2 | -0.6 | -7.9 | 3.2 | 3.4 | -2.3 | |

| Real net national disposable income | -0.5 | -0.2 | -7.3 | 5.2 | 4.9 | 2.1 | |

| Productivity | |||||||

| GDP per hour worked | 0.2 | 0.6 | 3.4 | -1.4 | - | 2.5 | |

| Real unit labour costs | 1.2 | -0.6 | -8.9 | -0.9 | 6.9 | -4.1 | |

| Prices | |||||||

| GDP chain price index (original) | -1.2 | 1.0 | -0.3 | -0.1 | 1.7 | 2.4 | |

| Terms of trade | -4.5 | 0.4 | 0.8 | 1.3 | 4.7 | 7.4 | |

| Current price measures | |||||||

| GDP | -0.2 | 0.3 | -7.5 | 4.0 | 4.2 | 0.6 | |

| Household saving ratio | 5.3 | 7.9 | 22.0 | 18.7 | 12.0 | na | |

na not available

a. Change on preceding quarter, except for the last column which shows the change between the current quarter and the corresponding quarter of the previous year. Excludes Household saving ratio.

b. Reference year for chain volume measures and real income measures is 2018-19.

c. Population estimates are as published in the National, state and territory population (cat. no. 3101.0) and ABS projections.

d. ANZSIC divisions A to N, R and S. See Glossary - Market sector.

Gross Domestic Product (GDP) rose 3.1% this quarter as COVID-19 related restrictions continued to ease. This follows a 3.4% rise in the September quarter 2020. The continuation in the recovery is reflected in through the year results, which improved from -3.7% to -1.1% in the December quarter.

The terms of trade rose 4.7% this quarter off the back of higher export prices, particularly for iron ore. The strength in the terms of trade contributed to a 4.2% increase in nominal GDP, the strongest rise since September quarter 1983.

Domestic final demand contributed 3.2 percentage points to GDP growth. Household final consumption expenditure contributed 2.3 percentage points as constraints on households and businesses continued to lift. Private investment contributed a further 0.7 percentage points to growth.

Spending by households rose 4.3% this quarter, but remained 2.7% down through the year.

Spending on goods rose 2.8% for the quarter and is up 6.2% through the year. Purchase of vehicles rose a record 31.8%, reflecting elevated household disposable income and shifting spending patterns with continued limitations on some expenditure items such as international travel.

Spending on services rose 5.2%. This reflects a partial recovery with spending down 7.8% through the year. Recreation and culture, hotels, cafes and restaurants and health all continued to rebound as movement and trading restrictions eased.

Household spending by Victorians increased 10.4% as strict lockdown restrictions were lifted. The level of spending remains weak at 7.2% below its pre-COVID level.

Household spending for the rest of Australia, excluding Victoria, rose 2.3% in the quarter.

The household saving to income ratio declined to 12.0% from 18.7% last quarter, remaining at elevated levels. Falls in gross disposable income and increases in household consumption both contributed to the decline in saving.

Gross disposable income fell 3.1% in the quarter, but remained strong through the year (up 4.8%). The quarterly fall reflected a decline in government support payments.

Private investment rose 3.9% for the quarter. Both housing and business investment increased, supported by government initiatives and improvements in conditions.

Ownership transfer costs (15.2%) and dwelling investment (4.1%) both contributed to the increase in housing activity. The rise in business investment was driven by a 8.9% increase in machinery and equipment.

GVA rose 2.7% this quarter, with rises in 17 out of the 19 industries. Favourable weather conditions contributed to a large grain harvest, which is reflected in a 26.8% increase in Agriculture, Forestry and Fishing GVA. The impacts of this flowed through the supply chain, including in Wholesale Trade (up 3.6%) and Transport, Postal and Warehousing (up 6.1%). The increase in agricultural production was also reflected in a 23.5% increase in rural exports.

Accommodation and Food Services, Administrative and Support Services and Arts and Recreation Services, industries that were heavily impacted by the pandemic, continued to rebound this quarter as restrictions eased. Despite this, the activity in all three industries remains well below pre-pandemic levels.

COE rose 1.5% this quarter as employment and hours worked increased. Private sector COE continues to recover after being strongly impacted during the onset of the pandemic, rising 1.4% for the quarter. Public sector COE grew 1.8% for the quarter to be 6.7% higher through the year.

a. Contributions may not be additive due to rounding.

Gross operating surplus plus gross mixed income (GOSMI) fell 5.7%, driven by non-mining industries as support payments from government declined.

Mining operating surplus partly offset the fall, rising 8.3%. The strong growth this quarter reflects rising iron ore prices and increased demand for Australia's LNG.

| % Change | % Change | % points contribution to growth in GDP | |||

|---|---|---|---|---|---|

| Sep 20 to Dec 20 | Dec 19 to Dec 20 | Sep 20 to Dec 20 | |||

| Final consumption expenditure | |||||

| General government | 0.8 | 7.4 | 0.2 | ||

| Households | 4.3 | -2.7 | 2.3 | ||

| Total final consumption expenditure | 3.2 | -0.1 | 2.4 | ||

| Gross fixed capital formation | |||||

| Private | |||||

| Dwellings | 4.1 | 0.6 | 0.2 | ||

| Ownership transfer costs | 15.2 | 15.3 | 0.2 | ||

| Non-dwelling construction | -1.9 | -6.2 | -0.1 | ||

| Machinery and equipment | 8.9 | -4.3 | 0.3 | ||

| Cultivated biological resources | - | 20.7 | - | ||

| Intellectual property products | 1.4 | -5.4 | - | ||

| Public | 2.5 | 1.8 | 0.1 | ||

| Total gross fixed capital formation | 3.6 | -0.9 | 0.8 | ||

| Changes in inventories | na | na | -0.1 | ||

| Gross national expenditure | 3.2 | -0.3 | 3.1 | ||

| Exports of goods and services | 3.8 | -11.7 | 0.8 | ||

| Imports of goods and services | 4.9 | -9.6 | -0.9 | ||

| Statistical discrepancy (E) | na | na | 0.1 | ||

| Gross domestic product | 3.1 | -1.1 | 3.1 | ||

- nil or rounded to zero (including null cells)

na not available

Income estimates are in seasonally adjusted current prices

| % Change | % Change | % points contribution to growth in GDP | ||

|---|---|---|---|---|

| Sep 20 to Dec 20 | Dec 19 to Dec 20 | Sep 20 to Dec 20 | ||

| Compensation of employees | 1.5 | 2.0 | 0.7 | |

| Gross operating surplus | ||||

| Private non-financial corporations | -7.5 | 11.7 | -1.9 | |

| Other(a) | 1.3 | 2.9 | 0.2 | |

| Gross mixed income | -12.7 | 13.6 | -1.3 | |

| Taxes less subsidies on production and imports | 727.5 | -44.2 | 6.6 | |

| Statistical discrepancy (I) | na | na | -0.1 | |

| Gross domestic product | 4.2 | 0.6 | 4.2 | |

- nil or rounded to zero (including null cells)

na not available

a. Includes Public non-financial corporations, Financial corporations, General government and Dwellings owned by persons.

| % Change | % Change | % points contribution to growth in GDP | |||

|---|---|---|---|---|---|

| Sep 20 to Dec 20 | Dec 19 to Dec 20 | Sep 20 to Dec 20 | |||

| Agriculture, Forestry and Fishing | 26.8 | 20.0 | 0.5 | ||

| Mining | -1.0 | -3.6 | -0.1 | ||

| Manufacturing | 1.2 | -2.0 | 0.1 | ||

| Electricity, Gas, Water and Waste Services | -0.9 | -2.8 | - | ||

| Construction | 0.3 | -5.2 | - | ||

| Wholesale Trade | 3.6 | 4.3 | 0.1 | ||

| Retail Trade | 3.7 | 6.3 | 0.2 | ||

| Accommodation and Food Services | 7.9 | -13.2 | 0.2 | ||

| Transport, Postal and Warehousing | 6.1 | -16.8 | 0.2 | ||

| Information Media and Telecommunications | 5.2 | 2.1 | 0.1 | ||

| Financial and Insurance Services | 0.4 | 2.9 | - | ||

| Rental, Hiring and Real Estate Services | 7.4 | -3.8 | 0.2 | ||

| Professional, Scientific and Technical Services | 4.7 | 1.9 | 0.3 | ||

| Administrative and Support Services | 9.4 | -14.0 | 0.3 | ||

| Public Administration and Safety | 0.8 | 5.5 | - | ||

| Education and Training | 0.2 | 0.8 | - | ||

| Health Care and Social Assistance | 2.2 | 2.4 | 0.2 | ||

| Arts and Recreation Services | 8.4 | -8.2 | 0.1 | ||

| Other Services | 9.9 | -7.2 | 0.2 | ||

| Ownership of dwellings | 0.4 | 1.7 | - | ||

| Taxes less subsidies on products | 8.6 | -1.2 | 0.5 | ||

| Statistical discrepancy (P) | na | na | - | ||

| Gross domestic product | 3.1 | -1.1 | 3.1 | ||

- nil or rounded to zero (including null cells)

na not available

| Percentage change from Sep 20 to Dec 20 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| NSW | Vic. | Qld | SA | WA | Tas. | NT | ACT | Aust.(a) | ||

| Final consumption expenditure | ||||||||||

| General government | 1.5 | 0.8 | -1.2 | 0.1 | 4.4 | 2.1 | -0.3 | -1.4 | 0.8 | |

| Households | 3.1 | 10.4 | 2.3 | 0.9 | 0.3 | 2.4 | 5.2 | 4.2 | 4.3 | |

| Gross fixed capital formation | ||||||||||

| Private | 4.2 | 5.1 | 4.9 | -1.5 | 1.5 | 8.4 | 14.1 | 4.8 | 3.9 | |

| Public | 2.2 | 1.5 | 4.1 | 6.1 | 1.3 | 5.7 | -0.7 | 0.8 | 2.5 | |

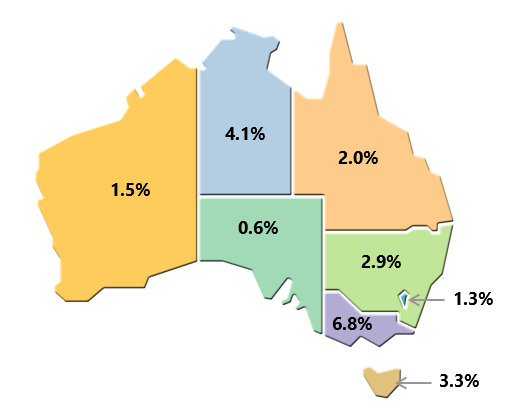

| State final demand | 2.9 | 6.8 | 2.0 | 0.6 | 1.5 | 3.3 | 4.1 | 1.3 | 3.3 | |

- nil or rounded to zero (including null cells)

a. Australia estimates relate to Domestic final demand.

The 2019-20 issue of the Australian System of National Accounts was released on 30 October 2020. This publication provides detailed, annual estimates of Australia's national accounts. These include expenditure, income and production estimates of gross domestic product (GDP), productivity estimates, sectorial accounts (for households, financial and non-financial corporations, general government and the rest of the world), and additional aggregates dissected by industry.

The 2018-19 issue of Australian National Accounts: Supply Use Tables was released on 30 October 2020. The Supply Use tables were introduced in the annual National Accounts in 1998 as an integral part of the annual compilation of the Australian System of National Accounts. They are used to ensure Gross Domestic Product is balanced for all three approaches (production, expenditure and income) and provide the annual benchmarks from which the quarterly estimates are compiled.

There are revisions in this issue due to the incorporation of more up-to-date data and concurrent seasonal adjustment.

Due to the impacts of COVID-19 on the economy, trend estimates for all series in the National Accounts have been suspended from June 2019 (inclusive). In the short term, this measurement will be significantly affected by changes to regular patterns in economic activity. If trend estimates were to be calculated without fully accounting for this unusual event, they would likely provide a misleading view of the underlying trend in the economy.

Series with significant and prolonged impacts from COVID-19 will use forward seasonal factors to produce seasonally adjusted estimates instead of the standard concurrent seasonal factors method. The forward factors approach is better suited to managing large movements at the end of a series and will ensure that large movements do not have a disproportionate influence on the seasonal factors.

This release previously used catalogue number 5206.0.