- This experimental indicator is derived from Australian Taxation Office (ATO) Business Activity Statements (BAS) turnover data from monthly BAS remitters. It includes 13 of the 19 industry divisions classified according to the Australian and New Zealand Standard Industrial Classification (ANZSIC), 2006.

- Monthly BAS reporting covers businesses with GST annual turnover of $20 million or more and a proportion of smaller businesses that report monthly on a voluntary basis.

- The estimated monthly changes in business turnover are aligned as closely as is feasible to the Australian System of National Accounts concept of market output. Users should exercise caution in comparing the indicator to other ABS economic outputs due to differences in scope, coverage, and methods.

- For further information see Methodology.

Monthly Business Turnover Indicator

Experimental indicator of business turnover derived from monthly Business Activity Statements

Key statistics

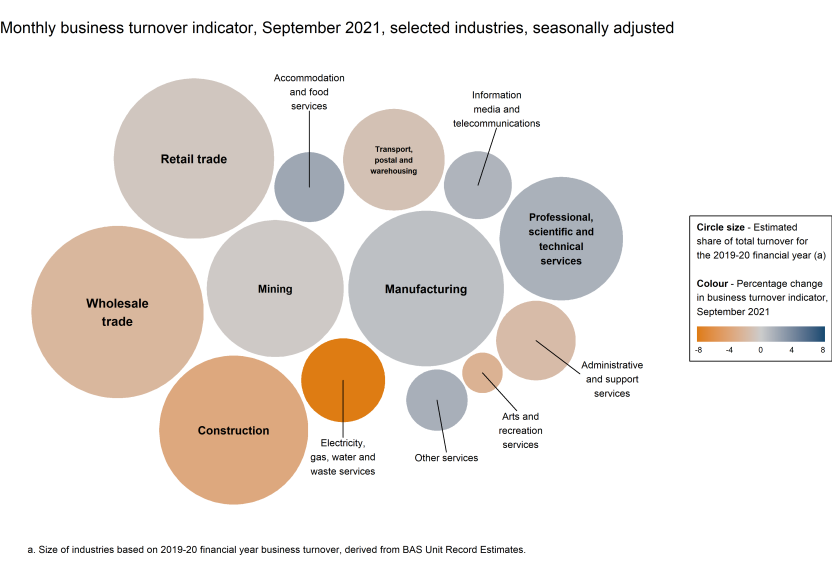

In seasonally adjusted terms, the monthly business turnover indicator showed:

- Falls in 8 of the 13 published industries in September 2021

- The largest decreases were in Electricity, gas, water and waste services (-8.2%) and Construction (-3.7%)

- Accommodation and food services recorded the largest rise (2.2%) following four months of consecutive falls

- Mining fell slightly (-0.3%) although showed a strong increase through the year to September 2021 (40.1%)

Industry

Total turnover differs between industries and this should be considered when analysing month-to-month movements to contextualise insights on overall economic activity. The chart below shows the monthly movements in the turnover indicator for September 2021 (represented by colour) and the selected industries' estimated share of total turnover for the 2019-20 financial year (represented by circle size).

Image

Description

Business turnover differs from the National Accounts concept of output. For example, the value of goods sold by wholesalers and subsequently retailers are reflected in turnover for both industries while National Accounts output measures the margins gained by each industry.

Industry analysis and charts

Electricity, gas, water and waste services (-8.2%) recorded the largest fall in September 2021 in seasonally adjusted terms, followed by Construction (-3.7%). In the year to September 2021, both industries have recorded an overall rise in business turnover.

Accommodation and food services recorded the largest rise (2.2%) following four months of consecutive falls. COVID-19 restrictions continued to significantly impact operations in this industry and the index remained well below pre-pandemic levels.

Mining was relatively unchanged in September 2021 (-0.3%), maintaining elevated levels from strong growth in previous months linked to commodity prices.

Mining

Manufacturing

Electricity, gas, water and waste services

Construction

Wholesale trade

Retail trade

Accommodation and food services

Transport, postal and warehousing

Information media and telecommunications

Professional, scientific and technical services

Administrative and support services

Arts and recreation services

Other services

Data downloads

ABS will progressively transition to releasing Excel files in .XLSX format from 3 December 2021. The time series spreadsheets in the Monthly Business Turnover Indicator will use the new format from the October 2021 issue, released on 10 December 2021. Users may need to update their automated processes for downloading and reading the data. Previously released time series spreadsheets will remain in .XLS format.

Time series spreadsheets

Table 01: Business turnover indicator, Mining - Monthly percentage change and index

Table 02: Business turnover indicator, Manufacturing - Monthly percentage change and index

Table 03: Business turnover indicator, Electricity, gas, water and waste services - Monthly percentage change and index

Table 04: Business turnover indicator, Construction - Monthly percentage change and index

Table 05: Business turnover indicator, Wholesale trade - Monthly percentage change and index

Table 06: Business turnover indicator, Retail trade - Monthly percentage change and index

Table 07: Business turnover indicator, Accommodation and food services - Monthly percentage change and index

Table 08: Business turnover indicator, Transport, postal and warehousing - Monthly percentage change and index

Table 09: Business turnover indicator, Information media and telecommunications - Monthly percentage change and index

Table 10: Business turnover indicator, Professional and scientific services - Monthly percentage change and index

Table 11: Business turnover indicator, Administrative and support services - Monthly percentage change and index

Table 12: Business turnover indicator, Arts and recreation services - Monthly percentage change and index

Table 13: Business turnover indicator, Other services - Monthly percentage change and index

Data Explorer datasets

Caution: Data in the Data Explorer is currently released after the 11:30am release on the ABS website.

Business Turnover Indicator - Monthly percentage changes and indexes, January 2010 onwards