| January 2024 to February 2024 (%) | February 2023 to February 2024 (%) | |

|---|---|---|

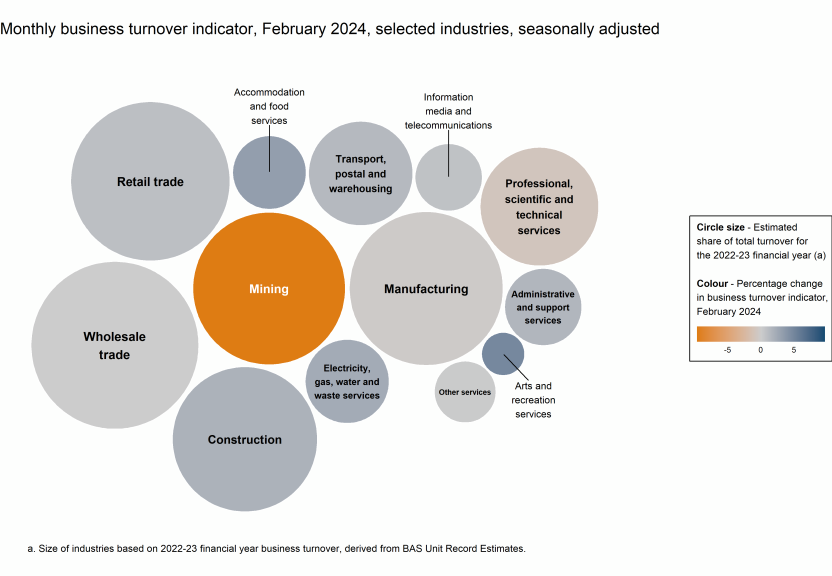

| Arts and recreation services | 4.8 | 9.8 |

| Accommodation and food services | 3.2 | 9.9 |

| Electricity, gas, water and waste services | 2.3 | 14.6 |

| Construction | 1.8 | 11.2 |

| Administrative and support services | 1.5 | 2.5 |

| Transport, postal and warehousing | 1.3 | 5.8 |

| Retail trade | 0.9 | 3.5 |

| Information media and telecommunications | 0.7 | 2.9 |

| Other services | 0.1 | 5.0 |

| Wholesale trade | 0.0 | 0.4 |

| Manufacturing | -0.2 | -0.1 |

| Professional, scientific and technical services | -0.8 | 5.8 |

| Mining | -9.6 | -13.8 |

Business turnover indicator, change in turnover, seasonally adjusted

["","January 2024 to February 2024","February 2023 to February 2024"]

[["Arts and recreation services","Accommodation and food services","Electricity, gas, water and waste services","Construction","Administrative and support services","Transport, postal and warehousing","Retail trade","Information media and telecommunications","Other services","Wholesale trade","Manufacturing","Professional, scientific and technical services","Mining"],[[4.7999999999999998],[3.2000000000000002],[2.2999999999999998],[1.8],[1.5],[1.3],[0.90000000000000002],[0.69999999999999996],[0.10000000000000001],[0],[-0.20000000000000001],[-0.80000000000000004],[-9.5999999999999996]],[[9.8000000000000007],[9.9000000000000004],[14.6],[11.199999999999999],[2.5],[5.7999999999999998],[3.5],[2.8999999999999999],[5],[0.40000000000000002],[-0.10000000000000001],[5.7999999999999998],[-13.800000000000001]]]

[]

[{"axis_id":"0","tick_interval":"","axis_min":"","axis_max":"","axis_title":"","precision":-1,"axis_units":"","tooltip_units":"","table_units":"","data_unit_prefix":"","data_unit_suffix":"","reverse_axis":false}][{"value":"0","axis_id":"0","axis_title":"%","axis_units":"","tooltip_units":"(%)","table_units":"(%)","axis_min":null,"axis_max":null,"tick_interval":null,"precision":"1","data_unit_prefix":"","data_unit_suffix":"","reverse_axis":false}]Index base period: July 2019 = 100.0.