- This experimental indicator is derived from Australian Taxation Office (ATO) Business Activity Statements (BAS) turnover data from monthly BAS remitters. It includes 13 of the 19 industry divisions classified according to the Australian and New Zealand Standard Industrial Classification (ANZSIC), 2006.

- Monthly BAS reporting covers businesses with GST annual turnover of $20 million or more and a proportion of smaller businesses that report monthly on a voluntary basis.

- The estimated monthly changes in business turnover are aligned as closely as is feasible to the Australian System of National Accounts concept of market output. Users should exercise caution in comparing the indicator to other ABS economic outputs due to differences in concepts, scope, coverage, and methods.

An Extraordinary Annual Seasonal Review (EASR) of the Monthly Business Turnover Indicator series was completed prior to the release of August data. See the Data Notes section for more information.

Monthly Business Turnover Indicator

Experimental indicator of business turnover derived from monthly Business Activity Statements

Key statistics

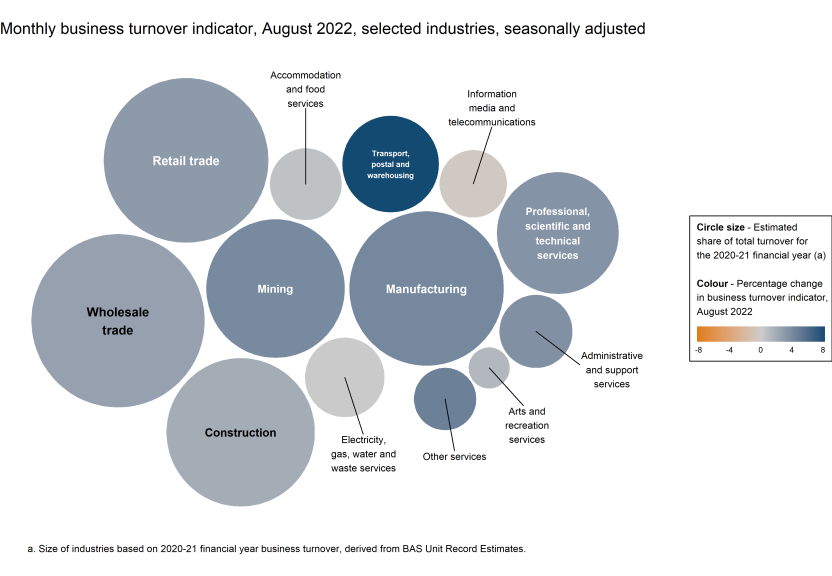

In seasonally adjusted terms, the August 2022 monthly business turnover indicator showed:

- Rises in 12 of the 13 published industries

- The largest rise was in Transport, postal and warehousing (8.2%)

- Through the year, rises were seen in all 13 published industries

Industry

Total turnover differs between industries. This should be considered when analysing month-to-month movements in the context of overall economic activity. The chart below shows the monthly movements in the turnover indicator for August 2022 (represented by colour) and the selected industries' estimated share of total turnover for the 2020-21 financial year (represented by circle size).

Image

Description

Business turnover differs from the National Accounts concept of output. For example, the value of goods sold by wholesalers and subsequently retailers are reflected in turnover for both industries while National Accounts output measures the margins gained by each industry.

Industry analysis and charts

In August 2022, 12 of the 13 industry divisions included in the indicator showed increases to turnover in seasonally adjusted terms. The largest rises in monthly turnover were seen in:

- Transport, postal and warehousing (8.2%)

- Other services (4.6%)

- Manufacturing (4.1%)

The increase in Transport, postal and warehousing was driven by shipping and logistics companies, as merchandise imports hit a record high as reported in the August International Trade in Goods and Services data.

The only industry to show a fall was Information media and telecommunications (-0.4%).

All industry divisions recorded year-on-year increases in business turnover in August 2022, compared with the COVID-19 Delta period in August 2021. The largest rises were recorded in:

- Accommodation and food services (72.1%)

- Electricity, gas, water and waste services (46.9%)

- Arts and recreation services (45.1%)

Mining

Manufacturing

Electricity, gas, water and waste services

Construction

Wholesale trade

Retail trade

Accommodation and food services

Transport, postal and warehousing

Information media and telecommunications

Professional, scientific and technical services

Administrative and support services

Arts and recreation services

Other services

Data downloads

Time series spreadsheets

Table 01: Business turnover indicator, Mining - Monthly percentage change and index

Table 02: Business turnover indicator, Manufacturing - Monthly percentage change and index

Table 03: Business turnover indicator, Electricity, gas, water and waste services - Monthly percentage change and index

Table 04: Business turnover indicator, Construction - Monthly percentage change and index

Table 05: Business turnover indicator, Wholesale trade - Monthly percentage change and index

Table 06: Business turnover indicator, Retail trade - Monthly percentage change and index

Table 07: Business turnover indicator, Accommodation and food services - Monthly percentage change and index

Table 08: Business turnover indicator, Transport, postal and warehousing - Monthly percentage change and index

Table 09: Business turnover indicator, Information media and telecommunications - Monthly percentage change and index

Table 10: Business turnover indicator, Professional, scientific and technical services - Monthly percentage change and index

Table 11: Business turnover indicator, Administrative support services - Monthly percentage change and index

Table 12: Business turnover indicator, Arts and recreation services - Monthly percentage change and index

Table 13: Business turnover indicator, Other services - Monthly percentage change and index

Data Explorer datasets

Caution: Data in Data Explorer is currently released after the 11:30am release on the ABS website. Please check the reference period when using Data Explorer.

For more information about Data Explorer, see the Data Explorer user guide.

Business Turnover Indicator - Monthly percentage changes and indexes, January 2010 onwards

Data notes

Review of seasonal adjustment

In early 2020 the ABS advised that the method used to produce seasonally adjusted estimates would be changed from the ‘concurrent adjustment’ method to the ‘forward factors’ method for series with significant and prolonged impacts from COVID-19. Given the ongoing disruption during the COVID-19 period and continuing use of forward factors, extraordinary annual reviews of seasonally adjusted series are progressively being undertaken across the ABS statistics programs.

The extraordinary annual review process assesses each series individually to determine how observations should be treated and determine the most appropriate approach (concurrent adjustment or forward factors) for estimating seasonal adjustment factors in the immediate future. Revisions arising from the annual review are relatively minor for most series, but series which have used forward factors are likely to have larger revisions because the seasonal factor estimates are annually updated to incorporate information from the previous year's observations.

Further information can be found in the Methods Changes During COVID-19 Period article.

The outcome of the review for the Monthly Business Turnover Indicator is that the concurrent seasonal adjustment method will be used for the ANZSIC divisions listed below, as COVID-19 is no longer having significant and prolonged impacts on these series:

- Construction

- Wholesale trade

- Retail trade

- Information media and telecommunications

- Professional, scientific and technical services

- Administrative and support services

Note that the Mining ANZSIC division has used the concurrent adjustment method since the indicator was first published.

Review of trend suspension

In early 2020 the ABS suspended trend series, in addition to adopting forward factors to produce seasonally adjusted series. The trend estimate indicates the medium to long direction of a time series. To estimate the trend, the effect of significant events like disruptions associated with COVID-19 are assigned to either the trend or irregular components of a time series. The rationale for suspending trend series was that it was unknown whether the impacts from COVID-19 would be short or medium to long-term, and therefore there was high probability of needing to significantly revise initial assessments of the impacts of COVID-19 on the trend.

For the ANZSIC divisions below, the trend series will be available in the September 2022 release, to be published on 09/11/2022:

- Construction

- Wholesale trade

- Retail trade

- Information media and telecommunications

- Professional, scientific and technical services

- Administrative and support services

For the majority of these divisions, the impacts of COVID-19 on the business turnover series have not caused multiple abrupt changes in the series level in short succession, and so it is appropriate to describe a trend level through the past two years. As a result, the trend will be published over the previous two years for these series, with the exception of Retail trade, for which the trend will be unavailable from March 2020 to February 2022 inclusive.