Introducing a new Childcare Services Cost Index

An information paper introducing the new Childcare Services Cost Index (CSCI).

Summary

- The ABS will release a new Childcare Services Cost Index (CSCI) from 31 January 2025, as a supplement to the quarterly Producer Price Indexes (PPI) publication.

- The CSCI will measure changes in prices paid by childcare providers for the goods, services and labour they purchase to provide childcare services to households.

A condition of the Government’s Early Childhood Education and Care Worker Retention Payment program for childcare providers who opt-in, is to limit fee increases. Changes in the CSCI amounts will be used as a guide for determining the limit that will apply from 8 August 2025 onwards. [1]

Feedback

This information paper is designed to inform key stakeholders and the community about how and when the ABS will commence publication of the CSCI.

The ABS welcomes any feedback and comments by 30 November 2024. These can be directed to prices.statistics@abs.gov.au.

Background

Price indexes published by the Australian Bureau of Statistics (ABS) provide summary measures of the movements in various categories of prices over time.

The ABS currently publishes a Childcare Index in the Consumer Price Index (CPI) publication. This index measures changes in out-of-pocket costs paid by households to childcare providers. Out-of-pocket costs include fees paid net of any subsidies received by households.

The ABS also publishes an Output price index for childcare services in the Producer Price Index (PPI) publication. This index measures changes in prices received by childcare providers for providing childcare services. The price received by childcare providers includes both fees paid by households and any subsidies received by providers.

The ABS was funded in the 2024-25 Budget to develop and publish a new Childcare Services Cost Index (CSCI) to measure changes in prices paid by childcare providers for the goods, services and labour they need to purchase to provide childcare services to households. This index will measure these costs from the perspective of businesses providing childcare services.

Early Childhood Education and Care Worker Retention Payment Program and the CSCI

In August 2024, the Government announced that it will provide an opt-in, Early Childhood Education and Care Worker Retention Payment program. Under this program, over two years, the Government will fund wage increases for the Early Childhood Education and Care (ECEC) workforce of 15% above the modern award rates. Providers who opt-in to this program must meet a range of conditions, as specified in the Grant Guidelines, including a fee constraint condition limiting fee increases to 4.4% between 8th August 2024 and 7th August 2025. From 8th August 2025 the results of the CSCI will be used as a guide for determining the annual fee growth limit which will apply. [2]

Businesses in scope of the CSCI

Childcare service providers represented in this index are businesses classified to the Australian and New Zealand Standard Industrial Classification (ANZSIC) class 8710, Childcare services. This class consists of businesses mainly engaged in providing day care of infants or children, including childcare services, before and/or after school services and childminding services.

Costs included in the index

The index covers a range of costs representative of those incurred by childcare providers. It will include consumables such as food, nappies and educational materials, purchased services such as cleaning, accounting and financial services. Costs for rent, lease and hiring costs are also included.

Labour costs make up a significant proportion of the index and include wages and non-wage components such as superannuation and payroll tax. Increases in wages funded by the Government through the Early Childhood Education and Care Worker Retention Payment program will be treated as a reduction in costs for providers and will therefore be netted off from the associated wage increases (see Attachment 1 in the Appendix).

The prices for these goods and services will be obtained from a variety of sources as outlined in Table 1.

| Goods and Services | Data source |

|---|---|

| Consumables such as food, nappies, educational materials and cleaning supplies | Scanner data from supermarkets (a) |

| Educational materials | Online data collected from representative retailers (a) |

| Services such as cleaning, accounting and financial services | Survey of providers of these services (b) |

| Rent | Commercial rents data (b) |

| Hourly wage rates | Survey of childcare provides already conducted as part of the Wage Price Index collection (c) |

| Early Childhood Education and Care Worker Retention program payments (offset to wage increases funded through this program) | Department of Education and a survey of childcare providers |

- This data is also used as an input into the Consumer Price Indexes.

- This data is also used as an input into the Producer Price Indexes.

- This data is also used an input into the Wage Price Indexes.

Structure and Weighting

Weights are an important element of a price index as they enable price changes for diverse products to be combined. The weights for the CSCI represent the average proportions that the various items being priced make-up of the total expenditure on goods, services and labour paid by businesses in the childcare industry. Larger sectors in the industry, like centre-based childcare, make up a higher proportion of industry-wide expenditure and therefore the weights align more closely with those sectors’ expenditure patterns than they do other parts of the industry. Price movements for items with higher weights have a correspondingly larger impact on the overall index than price changes for items with lower weights. As the index is designed to represent the entire industry, its results may not reflect the experience of individual businesses or sectors.

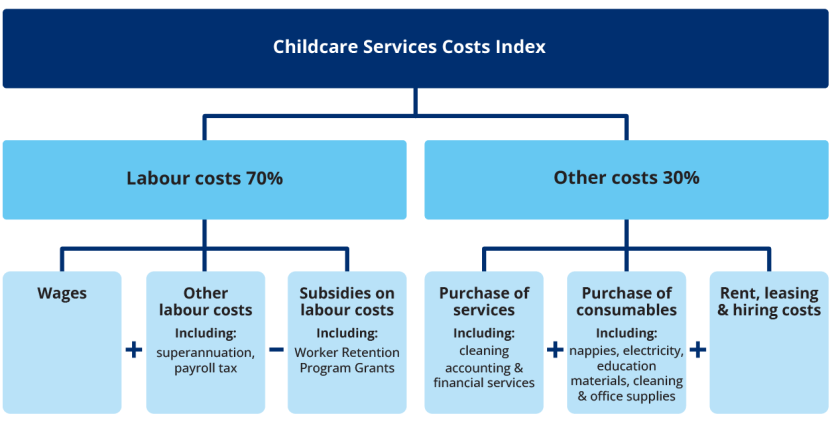

The structure and weights of the CSCI are based on the 2018-19 ABS Annual Industry Survey (AIS) which included a larger than usual sample for Australian and New Zealand Standard Industrial Classification (ANZSIC) Division Q (Health Care and Social Assistance). This data includes detailed financial information for the childcare industry, separated into cost categories. These categories are used as the weights for the index structure of the CSCI. Diagram 1 shows the CSCI index structure and weights for Labour and Other operating costs.

Diagram 1 - CSCI Structure and Weights

Image

Description

The first row of the flow chart there is one box that shows the top level Childcare Services Cost Index. In the second row, there are two boxes showing the two components that are combined to create the CSCI. On the left is Labour costs which has a weight of 70% in the index. On the right hand side is Other costs which has a weight of 30% in the index. The third row of the diagram breaks these two costs, Labour costs and Other costs into lower level categories. On the left hand side of the third row under Labour costs there are three boxes. These boxes include two items that contribute to Labour costs, Wages and Other labour costs, and one item that is subtracted from Labour costs, Subsidies on labour costs. Other labour costs includes superannuation and payroll tax and Subsidies on labour costs includes Worker retention program grants. On the right hand side of the third row there are three boxes that include items that contribute to Other costs. These are Purchase of services, Purchase of Consumables and Rent, leasing and hiring costs. Purchase of services includes cleaning, accounting and financial services and the Purchases of consumables includes nappies, electricity, education materials, cleaning and office supplies.

Timeseries Data

Based on this approach to price collection and weighting, a timeseries of the CSCI is articulated below. There is a noticeable trend in the index of larger movements in September quarters. This aligns with the usual timing of increases to award wages following Fair Work Commission Annual Wage reviews.

The annual movement of the CSCI through to September 2024 is 3.5%.

| Qtr | Index Numbers ; CSCI; Australia | Percentage Change from Previous Period ; CSCI; Australia ; | Percentage Change from Corresponding Quarter of Previous Year ; CSCI; Australia ; |

|---|---|---|---|

| Jun-19 | 100 | n/a | n/a |

| Sep-19 | 101.6 | 1.6 | n/a |

| Dec-19 | 101.8 | 0.2 | n/a |

| Mar-20 | 102.2 | 0.4 | n/a |

| Jun-20 | 95.7 | -6.4 | n/a |

| Sep-20 | 99.2 | 3.7 | -2.4 |

| Dec-20 | 99 | -0.2 | -2.8 |

| Mar-21 | 99.4 | 0.4 | -2.7 |

| Jun-21 | 99.8 | 0.4 | 4.3 |

| Sep-21 | 101.4 | 1.6 | 2.2 |

| Dec-21 | 101.6 | 0.2 | 2.6 |

| Mar-22 | 102.3 | 0.7 | 2.9 |

| Jun-22 | 103 | 0.7 | 3.2 |

| Sep-22 | 106.6 | 3.5 | 5.1 |

| Dec-22 | 107.3 | 0.7 | 5.6 |

| Mar-23 | 108.1 | 0.7 | 5.7 |

| Jun-23 | 108.6 | 0.5 | 5.4 |

| Sep-23 | 113 | 4.1 | 6 |

| Dec-23 | 113.3 | 0.3 | 5.6 |

| Mar-24 | 113.6 | 0.3 | 5.1 |

| Jun-24 | 113.9 | 0.3 | 4.9 |

| Sep-24 | 117 | 2.7 | 3.5 |

n/a - not available

Next steps

The CSCI will be published as a supplement to the Producer Price Indexes (PPI) quarterly publication. This publication is released 2 days after the Consumer Price Index publication which is released on the last Wednesday of the month following the end of each quarter.

An Australia level CSCI number will be published each quarter, together with the quarterly and annual index percentage change movements.

The first publication of the CSCI will be for December quarter 2024, on 31st January 2025.

Footnotes

2. Source: Early childhood wages - Department of Education, Australian Government (8/10/2024). The Department of Education website references a “new ECEC cost index”. The ABS has, however, named this index the Childcare Services Costs Index to better align with other related indexes produced by the ABS in the Consumer Price Index (CPI) and the Producer Price Index (PPI) and to align with the relevant Australian and New Zealand Standard Industrial Classification (ANZSIC).

Appendix

Labour Costs Conceptual Framework

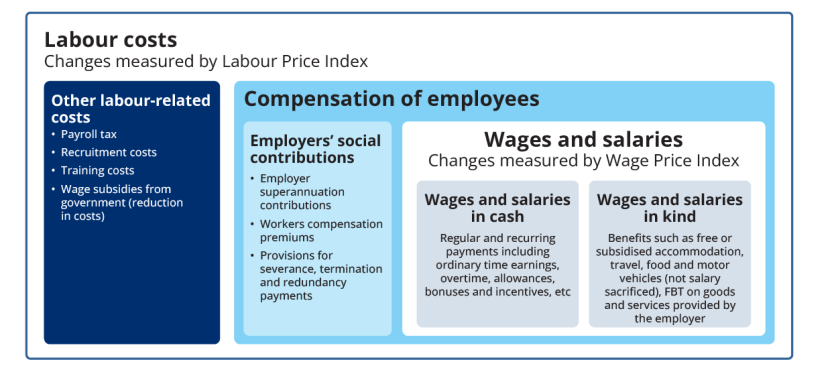

Attachment 1 below details the Labour Costs Conceptual Framework used to compile the Labour cost component of the CSCI.

Attachment 1: Labour Costs Conceptual Framework

Image

Description

This image shows the conceptual framework for Labour Costs. There are two large bubbles: one for Compensation of employees and one for Other labour-related costs. Inside the Other labour-related costs bubble are Payroll tax, Recruitment costs, Training costs, and Wage subsidies from government (reduction in costs). The Compensation of employees’ bubble contains two smaller bubbles inside: Employers’ social contributions and Wage and salaries. Inside the Employers’ social contributions bubble are Employer superannuation contributions, Workers compensation premiums, and Provisions for severance, termination & redundancy payments. Inside the Wages and salaries bubble are two smaller bubbles: Wage and salaries in cash (Regular payments including ordinary time earnings, overtime, allowances, bonuses and incentives, etc) and Wage and salaries in kind (benefits such as free or subsidised accommodation, travel, food and motor vehicles (not salary sacrificed), FBT on goods and services provided by the employer).