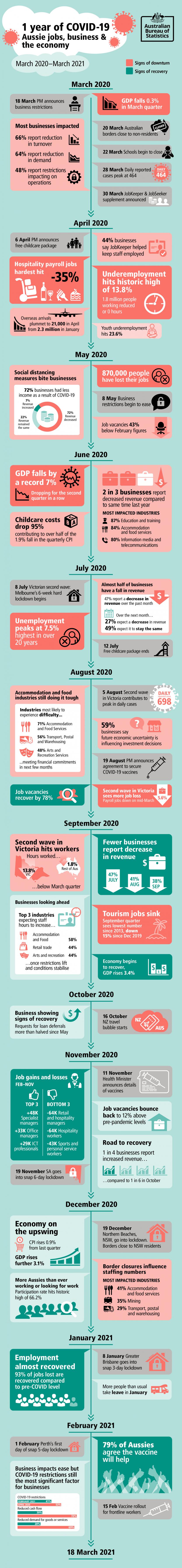

Timeline from March 2020 to March 2021

Subheading: March 2020

18 March, Prime Minister announces business restrictions.

GDP falls 0.3% in March quarter. Source: Australian National Accounts: National Income, Expenditure and Product.

20 March, Australian borders close to non-residents.

22 March, School begin to close.

28 March, Daily reported cases peak at 464.

30 March, JobKeeper and JobSeeker supplement announced.

Most businesses impacted: 66% report reduction in turnover, 64% report reduction in demand, 48% report restrictions impacting on operations.

Subheading: April 2020

6 April, Prime Minister announces free childcare package.

44% businesses say JobKeeper helped keep staff employed.

Hospitality (accommodation and food services industry) payroll jobs hardest hit minus 35%.

The underemployment rate hits historic high of 13.8%, 1.8 million people working reduced or 0 hours for economic reasons.

Overseas arrivals plummeted to just 21,000 from a record high of 2.3 million in January.

Youth underemployment (15-24 year olds) hits 23.6%.

Subheading: May 2020

Social distancing measures bite businesses. 72% of businesses had less income as a result of COVID-19, 22% revenue remained the same, 7% revenue increased.

870,000 people have lost their jobs.

8 May, Business restrictions begin to ease.

Job vacancies 43% below February figures.

Subheading: June 2020

GDP falls by a record 7% - dropping for the second quarter in a row.

2 in 3 businesses report decreased revenue compared to same time last year. Most impacted industries: 87% of education and training businesses, 84% of accommodation and food services, 80% information media and telecommunications.

Childcare costs drop 95% contributing to over half of the 1.9% fall in the quarterly CPI.

Subheading: July 2020

8 July, Victorian second wave: Melbourne’s 6-week hard lockdown begins.

Almost half of businesses have a fall in revenue, 47% report a decrease in revenue over the past month. Over the next month… 27% expect a decrease in revenue and 49% expect it to stay the same.

The unemployment rate peaks at 7.5% - highest in over 20 years.

12 July, Free childcare package ends.

Subheading: August 2020

Accommodation and food industries still doing it tough. Industries most likely to experience difficulty meeting financial commitments in the next few months, 71% Accommodation and Food Services, 56% Transport, Postal and Warehousing and 48% Arts and Recreation Services.

5 August, Second wave in Victoria contributes to peak in daily cases at 698.

59% businesses say future economic uncertainty is influencing investment decisions.

19 August, Prime Minister announces agreement to secure COVID-19 vaccines.

Job vacancies recover by 78%.

Second wave in Victoria sees more job loss. Payroll jobs down 5.6% in mid-March.

Subheading: September 2020

Second wave in Victoria hits workers. Hours worked down 13.8% in Victoria and 1.8% rest of Australia below the March quarter.

Fewer businesses report a decrease in revenue: 47% in July, 41% in August and 38% in September.

Businesses looking ahead. Top 3 industries expecting staff hours to increase once restrictions lift and conditions stabilise. Accommodation and Food 58%, Retail trade 44%, Arts and recreation 44%.

Tourism jobs sink. September quarter sees lowest number since 2013, down 15% since Dec 2019.

Economy begins to recover, GDP rises 3.4%.

Subheading: October 2020

Business showing signs of recovery. Requests for loan deferrals more than halved since May.

16 October, NZ travel bubble starts.

Subheading: November 2020

Job gains and losses Feb–Nov 2020. Top 3. Additional 48,000 Specialist managers, additional 33,000 Office managers, additional 29,000 ICT professionals. Bottom 3. Minus 64,000 Retail and hospitality managers, minus 64,000 Hospitality workers, minus 43,000 Sports and personal service workers.

11 November, Health Minister announces details of vaccines.

Job vacancies bounce back to 12% above pre-pandemic levels, highlighting recovery in employer demand.

Road to recovery, 1 in 4 businesses report increased revenue compared to 1 in 6 in October.

19 November, SA goes into snap 6-day lockdown.

Subheading: December 2020

Economy on the upswing, CPI rises 0.9% from last quarter. GDP rises a further 3.1%.

December 19, Northern Beaches, NSW, go into lockdown. Borders close to NSW residents.

More Aussies than ever working or looking for work. Participation rate hits historic high of 66.2%.

Border closures influence staffing numbers. Most impacted industries, 41% Accommodation and food services, 35% Mining, 29% Transport, postal and warehousing.

Subheading: January 2021

Employment almost recovered, 93% of jobs lost are recovered compared to pre-COVID level.

8 January, Greater Brisbane goes into snap 3-day lockdown.

More people than usual take leave in January.

Subheading: February 2021

1 February, Perth’s first day of snap 5-day lockdown.

79% of Aussies agree the vaccine will help.

Business impacts ease but COVID-19 restrictions still the most significant factor for businesses (bar graph). COVID-19 restrictions, February 2021 41%, April 2020 53%, Reduced cashflow February 2021 30%, April 2020 72% and Reduced demand for goods or services, February 2021 28%, April 2020 69%.

February 15, Vaccine rollout for frontline workers.